Through substantial product allegiance and customer loyalty, the largest company in the world, Apple Inc. (NASDAQ: AAPL), posted a second-quarter earnings beat, as resilient demand for their famous iPhone drove their revenues above the expectations of analysts. Described by legendary investor Warren Buffet as the best business in Berkshire Hathaway’s stellar portfolio, the share price rocketed by an impressive 5% following the earnings release, while it remains unknown whether the surge in buying momentum is justified.

Earnings per share for the quarter was $1.52 on revenue of $94.84Bn, above the expectations of $1.43 on $92.84Bn in revenue. The market welcomed the double beat as buyers stormed in to get their piece of the information technology giant. Despite multiple headwinds from the broader economy, they showed resilience in demand for their products.

Technical

An ascending channel has formed on the 1D chart as the share price continues to benefit from investors’ confidence in the business. The daily pivot point is at $165.71 and acts as support to the bulls who attempt to break through the channel resistance at $176.19. A sustainable break above the channel could lead the bulls toward $182.73 before reaching the estimated fair value of $189.94.

However, if the channel resistance holds, the bears could be enticed to break the channel down at the pivot support. A sustainable breakdown could open the possibility for a shift toward $157.30, $148.33 and $139.96 as lower potential entry points for the bullish investor.

Fundamental

The top-line beat in the company’s second quarter was attributed mainly to the robust sales in the iPhone segment, with revenues posting a March quarter record of $51.33Bn, up from $50.57Bn in the same quarter last year. This segment contributed 54% of the company’s sales for the quarter and offset a 31% and 13% contraction in the iPad and Mac segments. The March quarter iPhone sales record was not the only record the company set for the quarter, as its services revenue rose to an all-time record at $20.91Bn. Their bottom line also impressed investors, with the 44.3% gross margin exceeding the 44.1% expectation.

However, there are concerns about the company’s revenue growth, as their quarterly revenue contracted 2.5% in the recent quarter. Management also guided for $80.88Bn in revenue for the June quarter, lower than analysts’ expectations, citing that macroeconomic and foreign exchange headwinds will continue to pressure the short-term demand, even though these pressures are expected to ease in the latter parts of the year. The concern gets inflated when looking at the company’s valuations. The graph below shows the company’s P/E ratio against its revenue growth. While Apple’s P/E ratio is currently the second highest amongst its competitors at a multiple of 29.5X, its revenue growth is the slowest. As their share price rises and gets more expensive, their current revenue growth may not compensate for the growth premium factored into their share price.

However, their revenue still possesses tailwinds for expansion. CEO Tim Cook cited emerging markets and India in particular as one of the primary focal areas for Apple. Recently, they opened their first two stores in Delhi and Mumbai, with Cook telling investors that growth for the quarter was in strong double digits on a yearly basis. In 2022, Apple was already the second biggest revenue-generating brand in India, and it now looks to expand and capitalise on the movement of people into the middle class. Furthermore, Apple launched their high-yield savings account that offers a 4.15% annual return, bringing in almost $400M in deposits on its launch day, growing to $990M in the first four days since the launch. Investors will want to see these initiatives and growth avenues turn over into revenue growth that can justify their high valuation multiples.

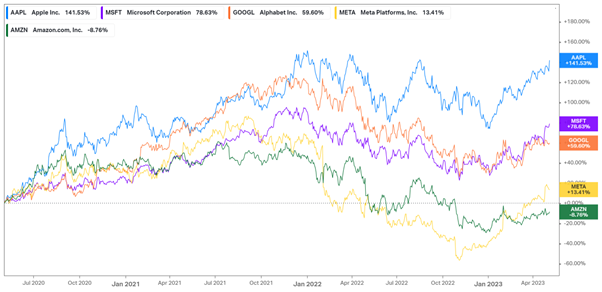

However, Apple becomes ever more attractive when it comes to rewarding its shareholders. From a share price perspective, Apple has outperformed its peers with a 141.53% return over the last three years. Additionally, the company has recently authorised a $ 90Bn share buyback program while increasing its quarterly dividend by 4% to $0.24 per share. Their dividend-paying ability is one of the reasons Warren Buffet speaks so confidently about the company, as Berkshire Hathaway is on course to receive a mammoth $842M in dividend income this year.

Summary

As the largest company in the world by market capitalisation, Apple enjoys a loyal customer base that allows it to enforce its pricing power over consumers to offset the rising costs in the current inflationary environment. Suppose they can continue to drive their initiatives and convert them into top-line expansion. In that case, the share price presents a 9% potential upside from current levels to the investor who believes in the company’s long-term growth prospects.

Sources: Koyfin, Tradingview, Reuters, Yahoo Finance, Investors Business Daily, Forbes, Apple Inc.