On Wednesday, Salesforce, Inc. (NYSE: CRM) reported its highly anticipated second-quarter results for fiscal 2024, which were well met by investors. Amidst the keen observance of industry analysts, Salesforce has seized the moment to reverse its margin trends, boldly charting a path toward enhanced profitability. Moreover, the company stands as an unwavering pioneer, shepherding its clients into the realm of AI innovation as the preeminent AI-powered CRM. With a 5.23% after-market gain, the company looks well poised to continue its stellar year-to-date momentum at the forefront of the AI hype.

Revenue for the quarter advanced 11% to $8.6Bn, driven by double-digit growth in subscription and support revenue growth. In doing so, the company exceeded the $8.5Bn forecast in a solid top-line quarter. However, much focus was put on its bottom line amid a cost-cutting strategy aimed at increasing its profitability. Once again, it did not disappoint, as earnings per share (EPS) surged from $1.19 in the prior year’s quarter to $2.12, easing past the $1.88 forecast.

Technical

On the 1D chart, a golden cross formation was followed by a resilient uptrend that peaked toward the end of July, followed by a pullback below the 50-SMA. Support was found at $204.59, where the market consolidated in anticipation of the earnings release.

The after-market surge leaves the share price above the 50-SMA, but the market could attempt to close the gap, with the first level of support established at $217.59. A breakdown at this level could enforce price below the 50-SMA toward lower support at $204.59 and $193.27, the 38.2% Fibonacci retracement from the mid-July peak. In the case of sustained downside, investors could look toward $187.39 and $185.07 as potential interest levels going forward.

However, if the market fails to close the gap and support is found above $217.59, the share price could ride the momentum toward the estimated fair value of $237.66, presenting another 5% potential upside from $226.44, the current after-market price.

Fundamental

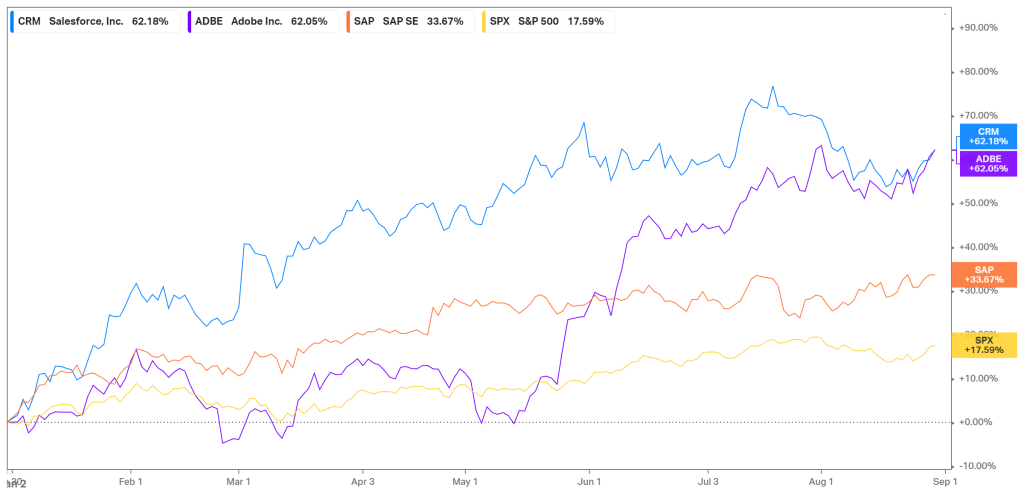

Salesforce has enjoyed a fruitful year to date, with its price appreciating 62.18%. While leading competitors like Adobe (62.05%) and SAP (33.67%), investors have been optimistic about the company’s growth path as it invested heavily into its AI prospects. As a result, Salesforce rode the rally in the broader technology sector, as it is believed to be one of the primary beneficiaries of the newly integrated generative AI abilities into numerous software technologies. However, all has not been sunshine and roses for the company, as much has been said about its contracting margins, which forced management into cost-cutting initiatives to boost its bottom line. So, what do the latest earnings tell us about the progress made on this front?

Source: FairMarkets Australia – Koyfin, Tiaan van Aswegen

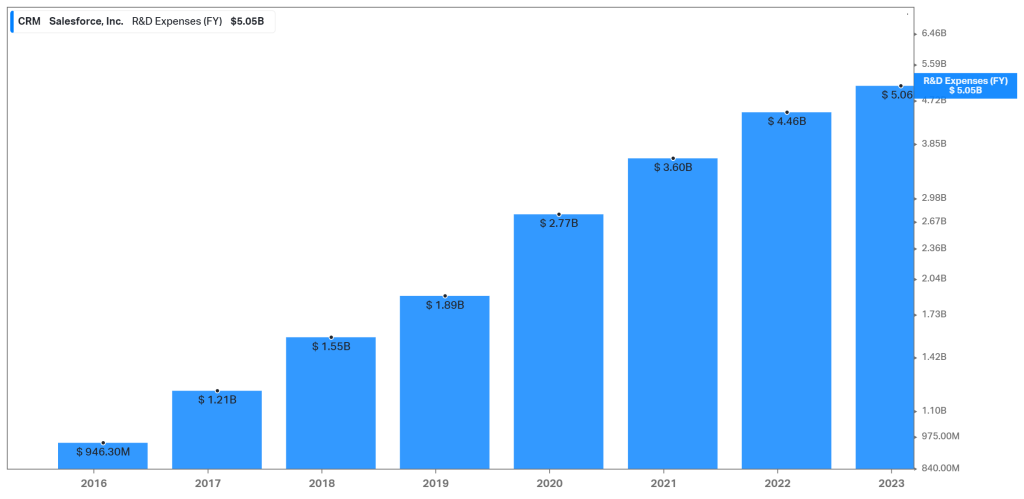

Firstly, it is worth noting the company’s efforts in increasing its research and development (R&D) costs to stay ahead of the game regarding technological innovation. In the last seven years, its R&D expenditure has grown rapidly from $946.30M in 2016 to $5.05Bn in 2023. While this trend is expected to continue in the upcoming quarters, the company will have to start showing the benefits of this investment in its operational growth soon to convince investors of its efficiency in allocating capital to projects that could unlock additional monetization of its existing offerings.

Source: FairMarkets Australia – Koyfin, Tiaan van Aswegen

The graph below shows the top-line performance over the last few quarters. While its revenue is no longer expanding at the rates seen in previous quarters, an 11% increase in revenue remains healthy for its current size. In the recent quarter, Subscription and Support revenue grew 12% to $8.01Bn, while its Professional Services and Other revenue rose 3% to $597M. In addition, its current remaining performance obligations increased 12% to $24.1Bn, with its total remaining performance obligations sitting at $46.6Bn. As we advance, revenue growth from AI will be a massive focal point, as Salesforce has introduced Marketing GPT and Commerce GPT to enhance its marketing cloud and commerce cloud operations by aiding businesses in automating repetitive tasks and delivering customized campaigns. With optimism around its growth increasing, management raised its fiscal 2024 outlook. It now expects revenue of $34.7Bn – $34.8Bn, up from the prior guidance of $34.5Bn – $34.7Bn. However, more focus has been placed on its bottom line, and the below graph highlights the reason. Net income has been under pressure recently, with increased costs offsetting its top-line expansion.

Source: FairMarkets Australia – Koyfin, Tiaan van Aswegen

However, Salesforce has made progress in bringing these costs down in recent quarters. In their latest report, operating expenses declined from $1.33Bn to $1.22Bn, led by a decline in marketing and sales costs from $3.42Bn to $3.11Bn. As a result, its margins have improved, with a 31.6% non-GAAP operating margin leading to the company exceeding its target three quarters early. Its gross profit margin also expanded from 72% in the year-ago period to 75%, highlighting the company’s progress toward profitability. Due to its efficiency in bringing down costs, management also raised its EPS guidance for fiscal 2024 from $7.41 – $7.43 to $8.04 – $8.06. This raise surprised the market, as it expected fiscal 2024 EPS of merely $7.45.

Source: FairMarkets Australia – Koyfin, Tiaan van Aswegen

Summary

For its tenth consecutive year, Salesforce remains the world’s largest CRM software provider by revenue. While enterprise demand for CRM software has come under pressure in the tight corporate spending environment, management has allocated its capital efficiently to invest heavily into the AI offerings that could drive its future growth. With progress being made in cutting costs to revive its bottom line and margin expansion, investors could feel more at ease with the company’s future path as we advance. With an estimated fair value of $237.66, the company still offers some upside to the bullish investor once its AI potential is fully reflected in its financial statements.

Sources: Koyfin, Tradingview, Insider Intelligence, Yahoo Finance, Wall Street Journal, Salesforce, Inc.