As doubts crept in about the lasting power of the AI stock surge, Nvidia Corporation (NASDAQ: NVDA) swirled in with a quarterly performance that shattered every rosy projection. With their latest earnings report, Nvidia not only met but exceeded towering expectations, coronating itself as the reigning monarch of AI. Sporting triple-digit growth on both its top and bottom lines, Nvidia stands unrivalled in prowess, and perched squarely in the vantage point of the technology realm’s AI revolution, they beckon a boundless trajectory, turning their already remarkable expansion into a marathon of growth.

Their recent quarter’s performance was nothing short of exemplary, as the boost in demand for AI computing systems has boosted the company’s growth at a quicker pace than expected. Coming into the release, expectations were already sky-high, but Nvidia made easy work of the lofty consensus. Earnings per share (EPS) amounted to $2.70, up a mighty 148% from the previous quarter and 429% higher than the $0.51 generated in the same quarter last year. It was also a healthy beat on the $2.09 consensus. Unsurprisingly, revenue came in 88% higher than the previous quarter at $13.51Bn, a 101% expansion from the prior year’s quarter’s $6.70Bn, while comfortably exceeding the $11.08Bn estimates. While these results were already mind-blowing, management went on to raise their guidance for the upcoming quarter, now expecting $16Bn plus or minus 2% in Q3, shattering the market’s expectation of $12.42Bn.

Technical

On the 1D chart, some consolidation occurred after the massive surge following their previous earnings release. The recent tech pullback resulted in a consolidatory channel downward, which experienced a breakout leading up to Wednesday’s earnings.

The 20-SMA currently trades above the 50-SMA, suggesting short-term bullish momentum, which could result in the share price continuing the upward momentum. However, a pullback below the support at $439.37 could see a momentum reversal toward $403.09 and $368.98.

If the market does not initiate a pullback, the share price could continue its current momentum, with the estimated fair value established at $529.49. This presents another 12.35% potential upside from current levels, as the share price could continue forming new highs and building its market cap beyond the impressive $1T mark.

Fundamental

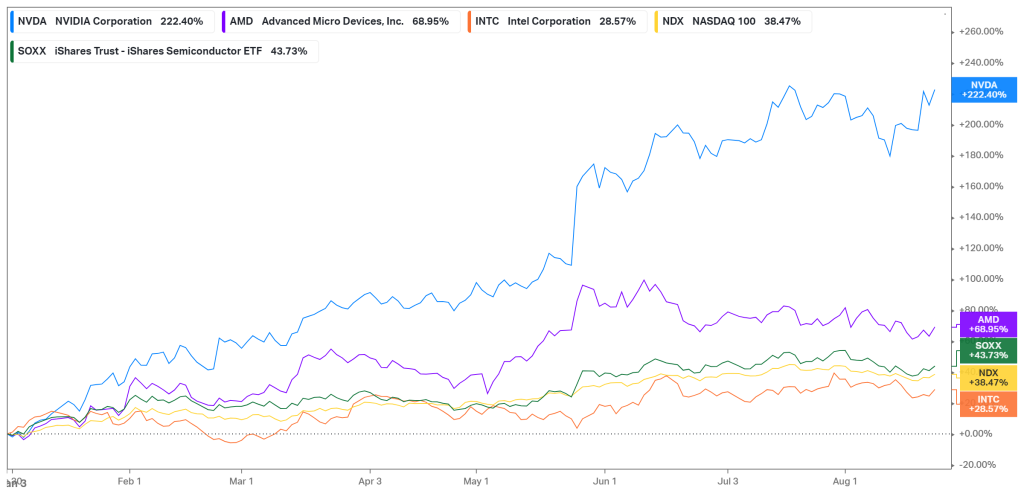

Year to date, Nvidia has delivered an unprecedented 222.40%, breaching the $1T mark in its market cap, as investors came flocking into the growth prospects that they possess. The company quickly established itself as the leader in the race of AI monetisation, with analysts estimating Nvidia holds roughly 70% of AI chip sales. Demand has skyrocketed for its H100 chip powering these AI models, and the company is estimated to ship around 550,000 H100 chips in 2023. With each chip going for around $ 40,000, it represents the astronomical revenue capacity for the new influx of demand. Their economic moat in the AI space has separated them from competitors such as AMD (68.95%) and Intel (28.57%) while outperforming the broader semiconductor sector, represented by the iShares Semiconductor ETF (43.73%) and the Nasdaq 100 (38.47%).

Source: FairMarkets Australia – Koyfin, Tiaan van Aswegen

The industry moat results from Nvidia’s decade-long investment in developing chips and software for AI, resulting in no competitor able to match them. The graph below shows the rise in capital expenditures over the last ten years, and this number is expected to rise as management attributes additional funding toward ensuring that they can match supply with the recent surge in demand.

Source: FairMarkets Australia – Koyfin, Tiaan van Aswegen

Analysts estimate that the demand for AI chips currently outstrips demand by at least 50%. This is reflected in the data centre revenue, which was up an astronomical 171% year over year at $10.32Bn, with the biggest sales driver coming from the HGX System, a supercomputing platform built around Nvidia’s chips driven by the development of large-language models and the integration of AI. Nvidia CEO Jensen Huang expects the AI boom to last well into next year as the industry shifts from traditional data centres that were built around central processors to new advanced data centres revolving around Nvidia’s powerful chips. The rising use of AI system-generated content poses well for the longer-term demand picture, which could continue to boost its data centre revenue. The company further announced that it would ship the Nvidia GH200 Grace Hopper Superchip this quarter for complex AI workloads. At the same time, the Nvidia L40S GPU, a data centre processor designed specifically for accelerating compute-intensive applications, will also be available over the next three months.

While Data Centres were the highlight of the segmental performance, Gaming Revenue also improved by 22% to $2.49Bn as it continues its recovery from the recent slump, while Automotive Revenue was up 15% to $253M. Professional Visualisation slipped by 24% to $379M but represents a small fraction of their top line. The graph below shows the recovery in Gaming Revenue, with the surge in Data Centres. While it paints an exceptional visual of recovery in its struggling segments with exceptional expansion in its growth departments, it reminds the investor that to sustainably operate at these high levels of revenue, management will have to find ways to ramp up supply to match the needs of the consumer.

Source: FairMarkets Australia – Nvidia Corporation, Tiaan van Aswegen

The supply ramp-up has, however, aided the company in expanding its margins above the industry average. The graph below shows Nvidia operating at a 70.05% gross profit margin, with its closest competitors operating between 35% and 55%. Similarly, its EBIT margin of 50.37% exceeds its closest competition of 21.57%. From a profitability perspective, these figures are highly optimistic, but can they retain the high levels of profit when the rising costs of ramping up supply kick in and the demand boom starts fading?

Due to the sensitive demand-supply dynamics in the industry, it is a highly cyclical operating environment. Recently, the industry went into a cyclical downturn, as shown below, with the rising level of inventories over the last two years. However, with the current booming demand, inventories are normalising, putting supply into focus. Navigating the supply chain will be crucial for the company as we advance, and management has revealed that they have already seen a 53% jump in inventory commitments to $11.15Bn due to the long-term supply needs for their Data Centre chips.

Source: FairMarkets Australia – Koyfin, Tiaan van Aswegen

Another potential risk for Nvidia is the export restrictions placed on advanced AI chip sales to Chinese companies last year. While Nvidia developed less powerful chips for its Chinese sales, there are talks of the Biden Administration enforcing further curbs that would prevent the sales of these chips to China without a government license. However, even with around 20% of revenue coming from China, analysts have shrugged off these risks, estimating EPS for the 2024 fiscal year at $8.29 on revenue of $44.54Bn. This revenue includes $32.41Bn predicted for Data Centers and reflects the expectation of a 71% top-line expansion from fiscal 2023.

With its share price nearing all-time highs, there has been talk about the valuation becoming stretched. However, the recent earnings result saw a shift in sentiment, as it was the first quarter where the company had proven its predictions on monetising its AI offerings, resulting in even more optimistic forecasts for its future earnings. With a P/E of 47.5X, it remains relatively overvalued compared to industry players like AMD (32.5X) and Qualcomm (13.1X). However, when factoring growth into the equation, its PEG ratio of 6.36X falls within the industry average and trades below the 17.36X of AMD, suggesting that the market realises the growth potential of its lucrative industry positioning. Nvidia also announced a $25Bn share buyback, a move not often seen when management believes the company is overvalued.

Source: FairMarkets Australia – Koyfin, Tiaan van Aswegen

Summary

With a near monopoly in the market for computing systems used to power generative AI tools such as ChatGPT, Nvidia showcased its strength against lofty expectations by smashing its latest earnings release out of the park. Suppose management is correct in predicting the continuation of the AI boom well into next year. In that case, the company is well-positioned to continue benefitting with lucrative top and bottom-line growth in upcoming quarters. In that case, the estimated fair value of $529.49 could very quickly come into play, offering a 12.35% potential upside from current levels.

Sources: Koyfin, Tradingview, Benziga, Nvidia Corporation