As earnings season starts to take full flight, investors turn their attention to American Express Company (NYSE: AXP), due to deliver their first quarter results for the fiscal year 2023 on Thursday. The company became one of the stalwarts of Warren Buffet’s portfolio due to its diversified business model prioritising shareholder value creation. Could they continue driving innovative growth during a problematic macroeconomic backdrop? Thursday’s earnings report could give investors the first signal.

In their previous financial year, the company reported record revenues of $52.86Bn on a surge in card member spending, while their EPS exceeded the estimates, coming in at $9.85. Despite challenging macroeconomics, the company reported results well above their guidance for the financial year. On top of that, the forward-looking projections revealed that the company expects revenue growth of 15%-17% in 2023 on earnings per share of $11.00 – $11.40. The first quarterly results should give investors insights into the company’s progress in meeting these goals.

Technical

On the 1D chart, the company is consolidating in a range between $157.74 and $165.39. The bears have taken control following the 14 February peak, retracing the bullish rally toward the 50% Fibonacci retracement level at $162.37. The earnings report could spark momentum in either direction to break out of the consolidation range.

A positive earnings report could reverse the downturn to move through the consolidation resistance toward $167.01, the 38.2% Fibonacci retracement. From there, the bulls could look to converge toward the fair value at $176.12, where it may meet resistance at $172.24.

Conversely, a negative report could support the bearish retracement toward the Fibonacci golden ratio at $157.74. A breakdown of the consolidation report could see further downside toward $151.14 and $143.80 before the potential convergence to fair value.

Fundamental

In the fourth quarter earnings report for 2022, American Express reported a stellar 133.3M active card users, up 10% from the previous year, as the company continues expanding its customer base. Total payment volumes rose 12% year on year to $413.3Bn in the latest quarter, a metric that will be under the spotlight in the upcoming report. Analysts expect an increase in total network volumes on strong consumer spending, which would have supported their discount revenues, the company’s largest revenue driver. In the previous quarter, discount revenues were up 25% year-on-year, to $8.183Bn, with further growth expected in the upcoming quarter. Net interest income amounted to $9.895Bn in revenue for the previous financial year, which is also likely to increase due to higher disbursements of loans as the company started lending more amid higher consumer spending patterns. However, as the US economy slows down, the top-line growth could face some pressure, but their business model might offer some protection from the broader downturn.

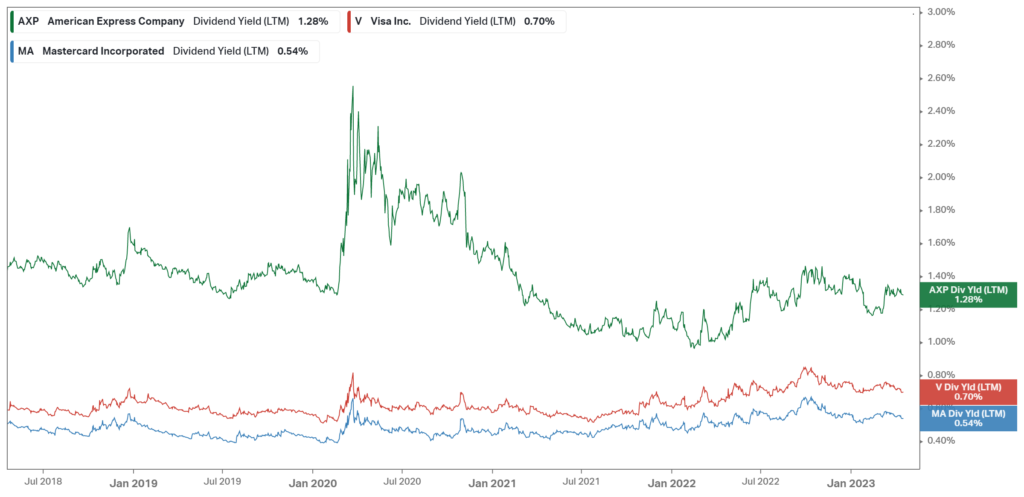

Because the company’s business model is focused on servicing a more wealthy customer base, they are generally less adversely affected by an economic downturn, as consumer spending remains relatively strong. To put it into perspective, the average transaction amount on an American Express card is $141 compared to the $75 and $80 from Mastercard and Visa. At the same time, the company has historically been aggressive in their share buybacks while paying healthy dividends to generate shareholder returns even when price appreciation is limited. These qualities provide the company with some sort of protection against broader moves in the macroeconomic cycle. The graph below shows how American Express has historically operated with a higher dividend yield than its industry peers.

However, no company is entirely safe from a recessionary environment. American Express can expect a likely decline in their net interest yield, as they are forced to pay higher rates on their loans to retain deposits. At the same time, the recession poses a risk of credit losses. The company recently reported an increase in net write-offs to 1.7% in March, compared to the 1.4% increase in February. At the same time, credit card delinquencies remained unchanged in March at 1.1%. These numbers are expected to increase as the economy continues to slow down.

From a share price perspective, American Express has outperformed its peers over a three-year period. With a 101.24% return over three years, the company remains relatively undervalued compared to its peers, with a 16.6X price/earnings ratio. Its closest competitor, Mastercard, has grown only 51% over the three years, with this return sending their price/earnings valuation to more than double that of American Express, at 36.5X.

Summary

In the wake of a macroeconomic downturn, American Express expects full-year 2023 revenue growth of 15% to 17% on earnings per share of $11.00 – $11.40. While the first quarter results are expected to show an increase in discount revenues, higher network volumes and a rise in net interest income, recession risks remain. A lower net interest yield and increasing risks of credit losses could start to show in the latter quarters of the year. However, with its quality characteristics in operating with a wealthy customer base with a strong dividend yield and share buyback programme, American Express is committed to returning value to its shareholders, which could result in a convergence of its share price to the estimated fair value of $176.12, presenting a 7% potential price upside.

Sources: Koyfin, Tradingview, Reuters, American Express Company