In another convincing earnings report, Applied Materials (NASDAQ: AMAT) once again proved its metal as the world’s largest supplier of semiconductor manufacturing equipment. After exceeding estimates on its top and bottom lines, management guided optimistically for the quarter ahead, sparking a bullish leg in the share price, hoping the semiconductor chip slump might be fading.

Revenue for the quarter declined year over year from $6.52Bn to $6.43Bn but remained above consensus of $6.14Bn. Similarly, its bottom line contracted by 2% as earnings per share (EPS) fell to $1.90, beating the forecast of $1.75 to the upside. The company’s profitability remains remarkable, with its gross margin touching 46.4% on a 28.3% operating margin, as it delivered a solid report across the board.

Technical

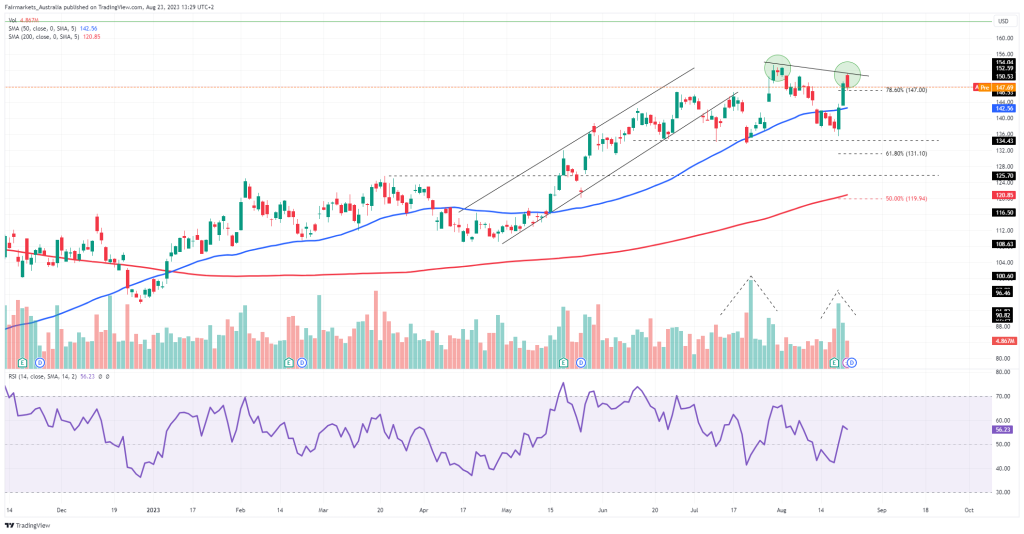

On the 1D chart, the share price trades above the 50-SMA, while a golden cross formation from January holds firm above the 200-SMA, indicating a continuation of the recent bullish momentum. While a temporary breakdown from an ascending channel briefly pushed the price below the 50-SMA, a subsequent recovery put the bulls on the front foot again.

However, two bullish legs on high volume have potentially formed a double top at the higher end of the uptrend, signalling a potential near-term pullback. Support at $147.00, the 78.6% Fibonacci retracement from the October bottom provides crucial support, as a breakdown could see the price reverting back below the 50-SMA toward lower support at $134.43. From there, the Fibonacci golden ratio at $131.10 and lower support at $125.70 could offer support before the 200-SMA comes back into play close to $119.94.

However, if support at $147.00 holds, a push above the $152.81 high could signal an uptrend continuation, with the estimated fair value of $164.17 within reach, offering an 11.2% potential upside from current levels.

Fundamental

In the technology sector, the hype around artificial intelligence (AI) has caused a significant bullish run year to date, with semiconductor giants like Nvidia surging close to 200%. Applied Materials have somewhat rode the wave, but not to the same extent, returning a still impressive 51.83%. This return is significant considering the recent slowdown in the electronics market, with a PC slump significantly reducing demand for the chips that Applied Materials provides manufacturing equipment for. However, with its optimistic prospects, it outperforms the Nasdaq 100 (36.28%) and ASML (22.17%) in its year-to-date return.

Source: FairMarkets Australia – Koyfin, Tiaan van Aswegen

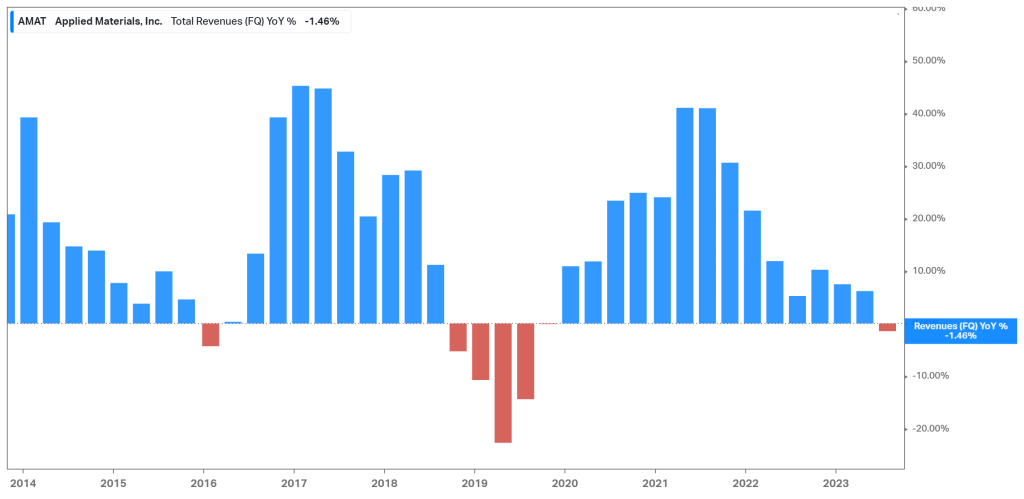

The cyclicality of the semiconductor industry is worth noting. Due to the sluggish macroeconomic conditions, the industry itself remains in a cyclical downturn, as indicated by Applied Material’s revenue growth in the graph below. Evidently, revenue growth has been on a steep decline, and while this would traditionally cause concern, management’s guidance for upcoming quarters has somewhat eased these fears. In their earnings presentation, the company indicated that they expect the semiconductor industry to reach $1T by 2032, driven by the Internet of Things (IoT) and AI. Due to numerous companies joining the enterprise race to join the digital and AI era, there has been an uptick in chip demand, which could bolster their top line as we advance. However, there has been concern about the company’s backlog. The backlog has been declining quarter on quarter, signalling potential demand weakness in the shorter term. The earnings failed to provide insight into the backlog situation, which could be a possible pivot point in their next quarterly release, which will also provide insight into the full-year performance.

Source: FairMarkets Australia – Koyfin, Tiaan van Aswegen

Management guided for revenue to tick up to $6.51Bn plus or minus $400M, which exceeded the market’s forecast of $5.95Bn. Upon closer inspection, its Semiconductor Systems segment, which generated $4.67Bn in the latest quarter, is expected to grow to $4.75Bn in the next quarter. The Applied Global Services Segment was guided for $1.42Bn, a slight reduction from this quarter’s $1.46Bn. Finally, their Display Revenue is expected to grow from $235M to $290M.

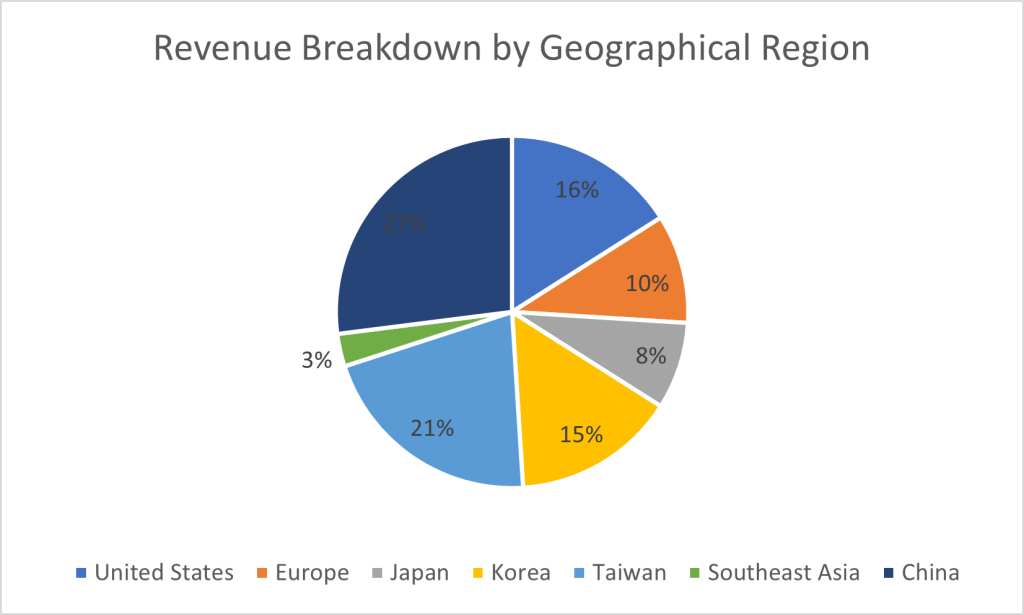

In the latest quarter, a lot of growth was attributed to resilient demand from China. The graph below shows China and Taiwan as the two largest revenue generators. While demand was strong in the latest quarter, there is still considerable risk from those geographies, as China’s economy continues to show signs of fading, and Taiwan has a substantial proportion of customers tied to the electronics segment. In the upcoming quarter, it will be interesting to monitor the revenue generation from these economies, as the company’s long-term growth prospects depend on stability in Chinese demand.

Source: FairMarkets Australia – Applied Materials,Inc., Tiaan van Aswegen

Management has, however, done well by focusing its strategy and investment decisions to accelerate the IoT and AI era. The graph below shows how management has kept up a healthy amount of capital expenditures ($255M in the latest quarter) to anticipate the influx of future demand. While generating a quarterly free cash flow of $2.33Bn, these investments can continue sustainably, positioning the company well for long-term sustainable growth.

Source: FairMarkets Australia – Koyfin, Tiaan van Aswegen

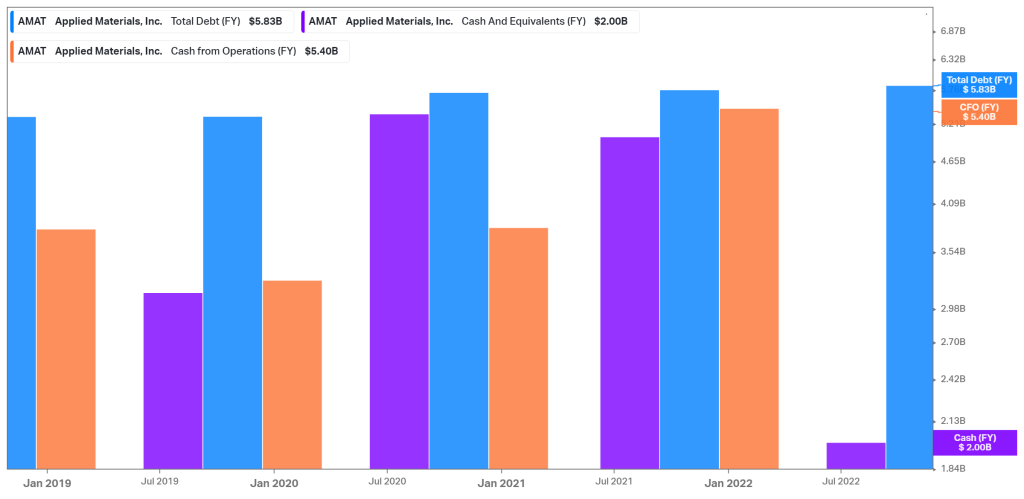

In addition, the company operates with a healthy balance sheet. The graph below shows the company’s ability to comfortably cover its debt with its existing cash position while generating sufficient cash from operations. The capital structure and working capital management have allowed the company to operate efficiently and productively, with the capacity to take on additional debt funding, if needed, to capitalize on any other opportunities presented in the market.

Source: FairMarkets Australia – Koyfin, Tiaan van Aswegen

Summary

Applied Materials delivered another double beat in their latest quarterly report, easing fears over the recent glut in the electronics market. Management is confident in the company’s long-term growth story, driven by AI and IoT. Suppose Applied Materials can continue to benefit from the surge in demand for AI chips while maintaining its efficient capital structure and balance sheet. In that case, there is an argument for convergence with the estimated fair value of $164.17, presenting an 11.2% potential upside from current levels.

Sources: Koyfin, Tradingview, Yahoo Finance, TheStreet, Applied Materials, Inc.