While investors have been chasing household names with a clear runway for AI expansion, Applied Materials, Inc (NASDAQ: AMAT) may have slipped under the radar. As one of the biggest semiconductor equipment manufacturers in the world, there may be a diamond in the rough, as they could be well poised to benefit from the frenzy in artificial intelligence investing.

With a semiconductor spurt in AI optimism, companies like Nvidia have taken the spotlight, surging close to 160% year to date. Although Applied Materials have returned a healthy 34% in the opening half of the year, it has gained little attention, and the returns look measly against some industry peers. Could this mean an opportunity at lower valuations, or are investors reasonable in their hesitation?

Technical

On the 1D chart, an uptrend emerged in April as the technology frenzy trickled into positive share price performance. However, it reached a potential peak on the last day of May at $136.57, where the bulls have failed to gain traction for additional upside.

Should they continue to face resistance from the market, the bears could start the retracement, where the 23.6% Fibonacci retracement at $131.69 is the first hurdle to a sustainable downside. A breakdown could test the uptrend at the 38.2% Fibonacci retracement at $127.41, where lower support at $123.96 and $120.51 could confirm the uptrend’s reversal.

However, these moves could open potential opportunities for the bullish investor who believes in the company’s growth prospects. The estimated fair value on a discounted cash flow basis is $147.87, presenting a 10.55% potential upside from the current level.

Fundamental

The company reported quarterly revenues on the 18th of May, generating earnings per share (EPS) of $2.00 on revenue of $6.63Bn. These metrics were up 8% and 6%, respectively, as the company beat estimates on both its top and bottom lines. Cash from operations amounted to $2.29Bn, rapidly expanding from the $415M year-ago number, while their Gross Margin ticked lower from 46.9% but remained healthy at 46.7%.

While the metrics were optimistic, there has been concern over constrained revenue growth. The graph below depicts the cyclicality of the company’s revenue growth, an industry-wide trend that is currently in its downturn. While revenue growth remains positive, it is slowing down year-over-year, and with management citing a weak chip market in their earnings call, we could see further downside in their top-line growth before the cyclical reversal occurs. The downturn is mainly attributed to a slowdown in the memory market, where makers of memory chips are facing a glut of inventory, which in turn forces them to lower their spending on equipment and the building of new factories, which weighs on Applied Materials’ top-line prospects. As a result, management guided for third-quarter EPS of $1.56 – $1.92 on revenue of $5.75Bn – $6.55Bn. While guidance exceeded consensus, it confirms that the memory market remains weak, and their strong performance in IoT, Communications, Automotive, Power, and Sensors (ICAPS) may not be enough to ensure higher revenue growth heading into the upcoming quarters.

The graph below further exaggerates this reality, with the company turning over its inventory at a lower rate in recent quarters. However, all is not doom and gloom, as it could signal the ease of the recent chip supply chain disruptions that shook the industry. As semiconductor equipment manufacturers turn over lower inventory, they could build up their supplies to benefit from the surge in AI-induced chip demand, where chipmaker spending on manufacturing equipment could rise. Additionally, they still turn over faster than their closest competitor, ASML. Regarding their bottom lines, ASML has historically been operating at higher margins, but Applied Materials are slowly closing the gap and becoming more efficient in their operational expenditure.

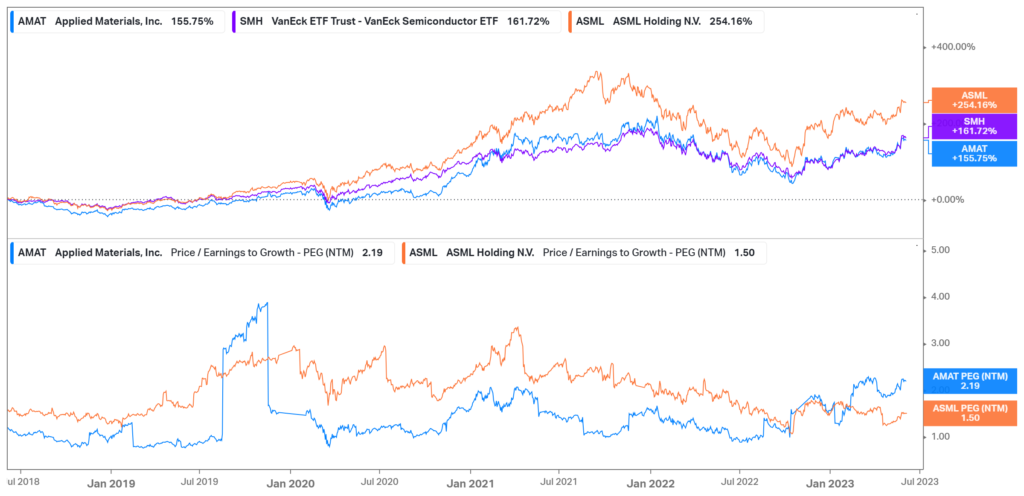

The semiconductor industry as a whole has been under the spotlight in recent weeks. With the development of generative AI, there is a rising demand for new chips, providing a long tailwind for industry expansion. Applied Materials mentioned the AI era in their latest quarterly report, citing it as the fourth and most significant age of computing while predicting the industry to grow to $1T over the next seven years. While the share price graph below shows Applied Materials underperforming relative to ASML over the last five years, its correlation to an industry ETF is impeccable, posing well for investors hoping that the company could ride the industry-wide optimistic run and future growth. However, it is worth noting that on a Price to Earnings Growth (PEG) basis, its price remains overvalued relative to ASML when considering future growth. While they generate slightly more revenue than its peer, investors need to weigh whether they believe the company is sufficiently better positioned to capture the necessary growth to justify the higher multiple.

Summary

With the market placing a lot of focus on household names like Nvidia, there could be opportunities in less popular companies that are just as well positioned for capturing AI growth. For the investor who believes that Applied Materials fall under that category, there is a 10.55% potential upside from current levels if the broader memory chip market constraints start to ease.

Sources: Koyfin, Tradingview, TheStreet, Reuters, Yahoo Finance, Applied Materials, Inc.