As the world’s largest asset manager, BlackRock, Inc. (NYSE: BLK) has once again shown why they are considered a financial powerhouse, with a double beat in a solid set of quarterly earnings. While their revenue slipped, the bottom-line expansion was immense as the company continued to grow its astronomical assets under management.

BlackRock generated earnings per share of $9.28 against the $8.42 consensus, showcasing an impressive 26% bottom-line growth. Revenues, on the other hand, were down from $4.53Bn to $4.46Bn as challenging market movements weighed on their assets under management (AUM) but still exceeded the forecast of $4.45Bn. Rounding off the solid set of results was a $831Bn expansion in their AUM, as net inflows were consistent across all client types and regions.

Technical

On the 1D chart, an ascending channel has formed, where dynamic resistance could halt the current upward momentum toward the daily pivot support at $723.95. The initial reaction to the earnings release was cautious, which could aid the bears in using the dynamic resistance to trigger the downside correction.

Support is established at the lower end of the channel, around $700.31, where a breakdown could trigger a larger selloff toward $674.16 and $650.71. However, on a discounted cash flow basis, the estimated fair value is at $782.37, presenting a 5.7% potential upside from current levels. Therefore, any bearish move could result in a widening of the divergence gap between price and value.

However, on the upside, the channel resistance provides a barrier to a sustained rally. Higher resistance at $763.88 could also come into play in the longer term providing an additional challenge to the bulls on their journey to convergence.

Fundamental

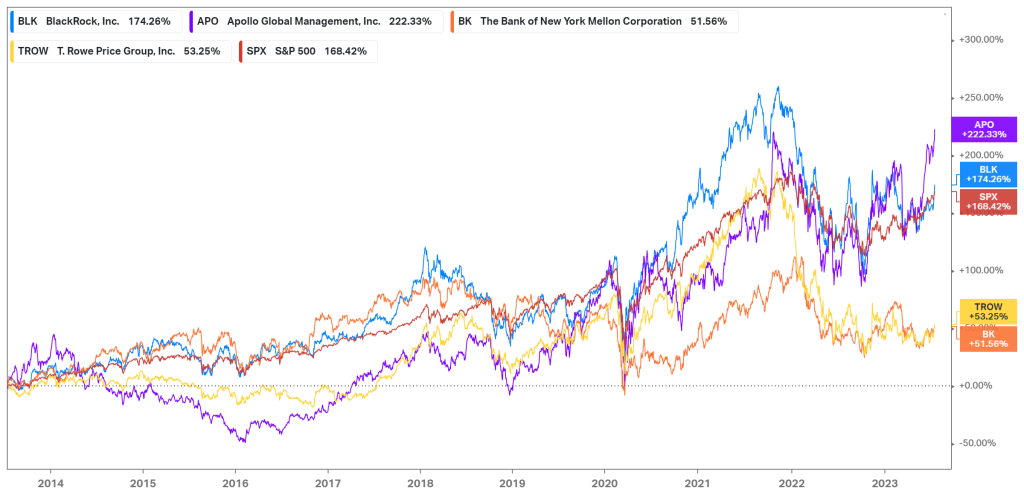

In the past ten years, BlackRock (174.26%) has outperformed the S&P 500 (168.42%) while providing more consistent returns than its industry peers. However, it is worth noting its correlation to the broader stock market. In bull markets, unsurprisingly, the company’s share price has done exceptionally well. Still, the same trend is evident during bear markets, where the contraction is generally more extensive than the broader market. This comes as no surprise, and with the current uptrend in the US markets, BlackRock looks well-positioned to grow its impressive, diverse portfolio of assets in the upcoming quarters.

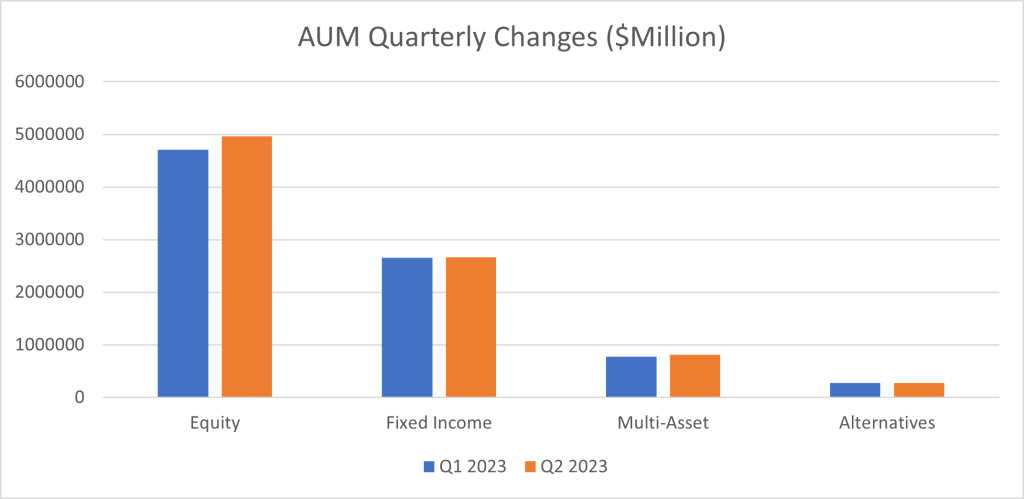

When delving into their latest quarter, their AUM increased from $9.09T to $9.43T, reflecting an $830M increase, as positive market movements and a $80.1Bn net inflow aided their expansion. Regarding product types, their equity portfolio grew from $4.71Tn to $4.96T, while their fixed income portfolio expanded from $2.65T to $2.69T. The multi-asset portfolio also increased from $771.8Bn to $811.93Bn, but their alternative asset portfolio contracted from $274.37Bn to $272.95Bn.

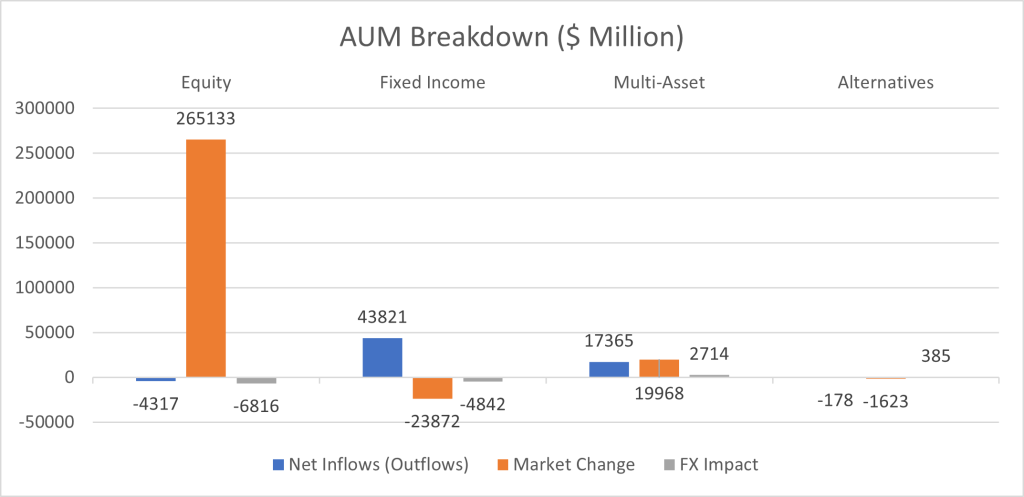

However, when looking at the sources of the portfolio expansion and the foreign exchange impact over the latest quarter, it is noticeable that there was a $-4.32Bn net outflow from their equity portfolio with a $-6.82Bn foreign exchange impact. This was primarily offset by the significant market change in the portfolio of $265.13Bn. It becomes evident that customers were flocking into fixed income during the quarter, with net inflows of $43.82Bn, but the market change offset this inflow by $-23.87Bn and a foreign exchange impact of $-4.84Bn. In total, the net inflows for the quarter were $80.16Bn, down from the prior quarter’s $103Bn, mainly driven by a $48Bn ETF inflow, with a $261.49Bn total market change, which was slightly offset by a foreign exchange impact of $-6.71Bn.

Investment advisory, administration fees, and securities revenue for the quarter were up from $3.33Bn to $3.61Bn. Still, it stagnated from the $3.69Bn in the prior year quarter due to the unfavourable impact of market beta on their AUM. Securities lending revenue increased from $160M in the second quarter of 2022 to $184M as the company benefited from higher spreads. Technology services revenue was up from $332M to $359M as they continued to experience strong demand for Aladdin. Annual Contract Value (ACV) from their technology services also expanded by 8%. At the same time, total expenses of $2.85Bn rose slightly from the $2.81Bn in the previous quarter but improved from the $2.86Bn in the same quarter of last year. Operating margins are down slightly from 43.7% in Q2 2022 to 42.5%.

In non-earnings-related news, BlackRock recently filed an application with the Securities Exchange Commission (SEC) to launch a spot-Bitcoin ETF, which would track the cryptocurrency’s price. This could be instrumental in solving the current barrier of integrating cryptocurrency holdings into a portfolio due to the need for a separate account. Analysts estimate that should the filing get approved, an additional $30T worth of capital could be unlocked, providing an exciting tailwind for the asset manager.

Summary

BlackRock is well-renowned for its extensive and diversified portfolio of assets, with a constantly rising AUM. With $190Bn of net inflows in the first half of the year, and strong investment performance, the company continues to sustainably grow its portfolio organically. With revenues slightly contracting in a quarter that had high expectations, investors may have been left wanting more. However, the company, under Larry Fink, has an impressive track record, and with the market conditions turning favourable, BlackRock is well-positioned to benefit from an improving market while managing its assets efficiently to protect its investors from any adverse effects. With its estimated fair value of $782.37, the company presents a 5.7% potential upside from current levels for the bullish investor.

Sources: Koyfin, Tradingview, Reuters, Yahoo Finance, BlackRock, Inc.