Broadcom Inc. (NASDAQ: AVGO) was the latest semiconductor company to take the stage and reveal how its quarterly earnings have benefitted from the recent boom in AI demand. As expected, the structural shift in the industry landscape aided the company in beating consensus on its top and bottom lines. Yet, with cautious guidance for the next quarter, a 4.5% post-market tumble ensued. As peers like Nvidia navigate a different path, the question arises: Is Broadcom poised to lose its competitive edge, or can it reclaim its footing?

Broadcom generated earnings per share (EPS) of $10.54 on revenue of $8.88Bn, exceeding the performance in the year-ago period, where it generated EPS of $9.73 on revenue of $8.46Bn. With the market expecting EPS of $10.43 on revenue of $8.86Bn, the results looked promising at first glance. However, with management guiding for revenue of $9.27Bn in the upcoming quarter, only 4% higher than the year-ago figure, the market was disappointed, as it missed the $9.29Bn expectation.

Technical

On the 1D chart, the 25-SMA has recently slipped below the 50-SMA, suggesting a shift in the shorter-term momentum at the top of the longstanding uptrend. With the market hesitant to move above the supply zone resistance at $922.90, the after-market selloff could be the start of a more prolonged pullback.

The first potential level of support for the pullback could be at $880.34, where a breakdown could see the share price move below the 50-SMA toward $848.32. The market could then look at retesting the breakout point from the temporary downtrend around $820.35 before reaching the 23.6% Fibonacci retracement from the peak reached before the earnings on Thursday. In the case of sustained downside, the share price could move as low as $778.31 in the longer term, where neckline support is established.

The estimated fair value for the company is $947.98. From Thursday’s close, this represents a measly 2.7% potential upside. However, with a possible pullback on the cards, the potential upside could widen at the lower support levels of $880.34 and $848.32.

Fundamental

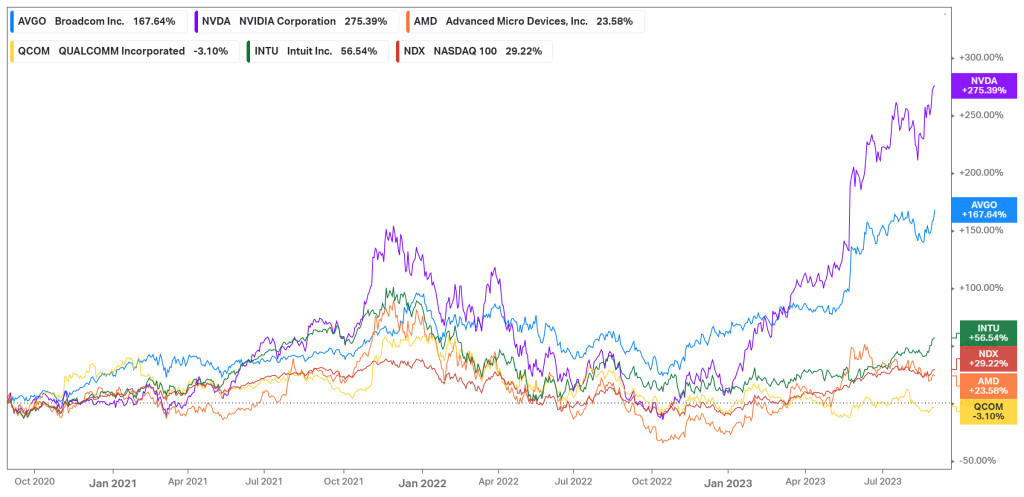

Over the last three years, Broadcom has rewarded its investors with a stellar 167.64% price return. Even though it lags behind Nvidia’s unprecedented 275.39%, it has done better than any of its competitors in trying to match this performance. With the benefit of the AI-induced tech rally in 2023, there has been a lot of optimism around Broadcom’s future, as the company shattered the Nasdaq 100’s 29.22% return over the same period. However, with a significant appreciation like that, investors would want to see some monetary value on the financial statements to back up the hype around its future. So, in the latest quarterly report, how did Broadcom weigh up to its competitor, Nvidia, which also reported earnings recently?

Source: FairMarkets Australia – Koyfin, Tiaan van Aswegen

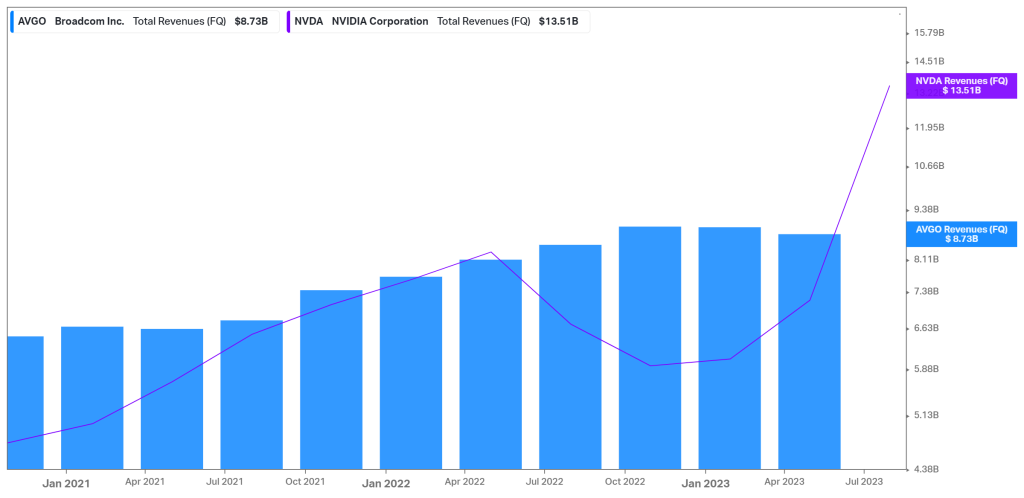

Looking at the top line, Broadcom has not yet reached the immaculate growth rates that Nvidia was able to unlock in its recent quarters. Broadcom’s latest quarterly revenue was only up 5% year over year, compared to the 101% expansion of its industry peer. CEO Hock Tan acknowledged the fact that the company’s top line received a boost from investments in AI computing, with the booming demand for next-generation networking technologies, as hyper-scale customers attempt to scale out and network their AI clusters within data centres. The company’s revenue from Semiconductor Solutions advanced 5% to $6.94Bn but missed the consensus for $6.97Bn. Investors are cautious about the fact that a slowdown in enterprise spending and increasing competition in the networking chip realm outweigh the benefits the company receives from the surging AI demand. Its smaller segment, Infrastructure Software, rose from $1.84Bn to $1.94Bn, rounding off a decent quarter of top-line performance.

Source: FairMarkets Australia – Koyfin, Tiaan van Aswegen

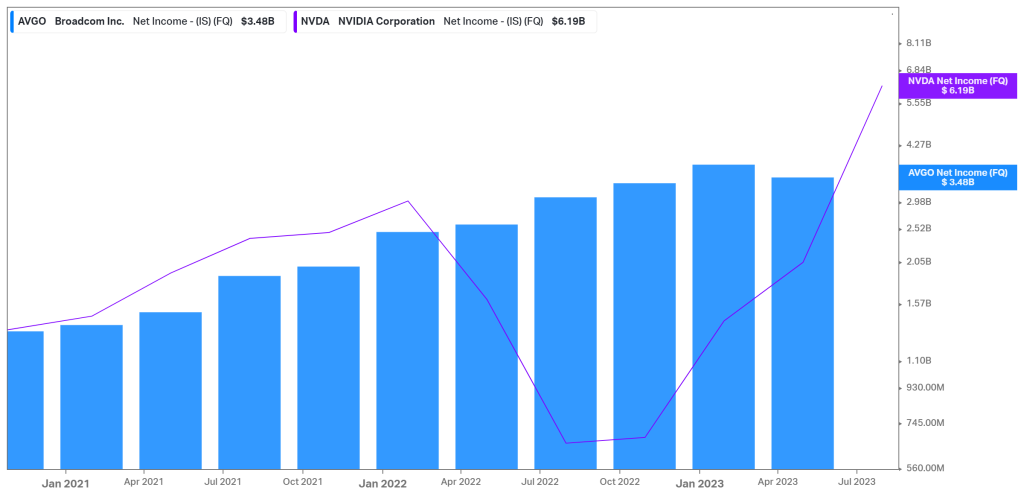

A very similar trend is observed in the analysis of the company’s bottom line, as shown in the net income below. While Broadcom’s net income has been relatively stable, rising from $3.30Bn to $3.48Bn, Nvidia has shown rapid progress on that front, with their economies of scale allowing the company to expand its net income from $745M in 2022 to a mammoth $6.19Bn. It now generates double the net income of Broadcom, where it used to trail significantly below.

Source: FairMarkets Australia – Koyfin, Tiaan van Aswegen

In terms of efficiency and profitability, Broadcom has maintained stable margins. Its gross profit margin has fluctuated around 75%, with its EBITDA margin in the high 50s range. For the upcoming quarter, management guided for an EBITDA margin of 65%, signalling healthy profitability and efficiency. Nvidia’s margins have not yet reached those of Broadcom, but as with all its other metrics, margins are on the rise. If the current trend continues, it could converge with those of Broadcom as we advance. Therefore, Broadcom’s management will look at ways to accelerate its growth and keep up with the likes of Nvidia in order to maintain its current share in the market and prevent losing out on volumes to its competitors.

Source: FairMarkets Australia – Koyfin, Tiaan van Aswegen

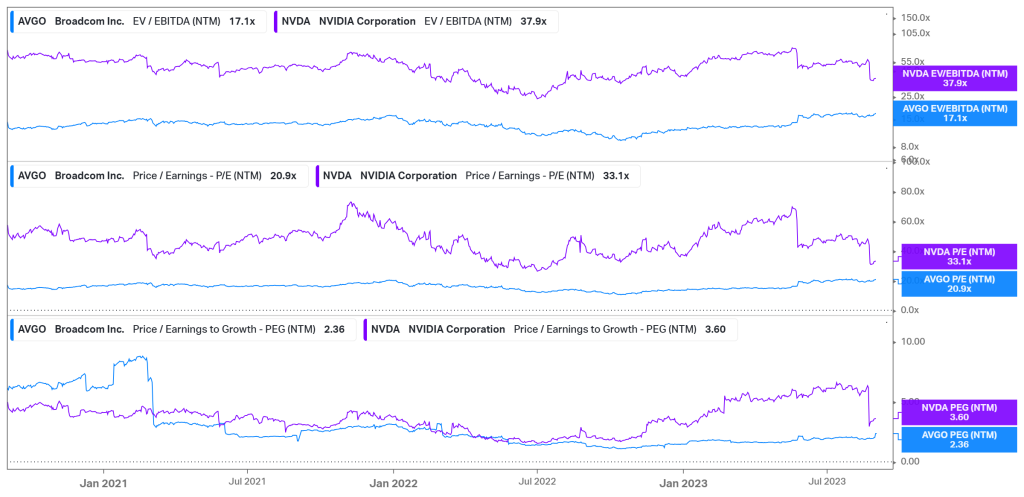

With Nvidia’s revenue and earnings growth far exceeding Broadcom’s, with margins quickly catching up, one would assume the valuation of Broadcom to be lower. This is exactly the case, as seen below, with Broadcom’s EV/EBITDA of 17.1X more than half of Nvidia’s 37.9X. Similarly, its P/E of 20.9X trades below its competitor’s 33.1X by some margin. However, when looking at the PEG ratio, the valuations are much closer, as investors have priced in an attractive growth path for Nvidia. With a PEG ratio of 2.36X, Broadcom remains undervalued relative to Nvidia when considering growth, but the gap is narrowing. This leaves the conclusion that while Broadcom is more fairly priced relative to its current fundamentals, it might be falling behind on the growth spectrum, putting it at risk of losing market share to Nvidia, who might be a more expensive option but with a clearer path of expansion in the future.

Source: FairMarkets Australia – Koyfin, Tiaan van Aswegen

Summary

Broadcom’s quarterly results were positive from face value, beating consensus on its top and bottom lines. However, its lower guidance starkly contrasts its industry peers, who have guided optimistically for the quarters to come. While Broadcom is showing healthy profitability on a solid top line, its growth prospects may be meagre compared to industry peers, and the benefits of the AI-induced demand have not yet trickled over into the high growth rates investors see in the industry. However, the prospects are there, and at a relatively fair price, the estimated fair value of $84.73 still presents some upside potential if management can unlock that incremental growth.

Sources: Koyfin, Tradingview, Reuters, Yahoo Finance, Broadcom Inc.