The Charles Schwab Corporation (NYSE: SCHW) found itself in a tricky financial fumble during the global banking crisis, and it’s been a rocky road to recovery ever since. As interest rates soared, its deposit growth took a tumble, creating quite the puzzle. Investors turned their back on the company, leaving it vulnerable to a massive loss in value. But now, armed with fresh cost-cutting tactics, can this financial wizard steer its way back to the treasure trove of past success?

Charles Schwab is well known as a discount broker with a sizeable deposit-gathering business, which has come under significant pressure in the high-interest rate environment. In its previous quarterly report in July, the company reported a 9% decline in net revenues to $4.66Bn, while adjusted net income plunged 25% to $1.49Bn. As a result, adjusted earnings per share slipped from $0.97 to $0.75 with a pre-tax profit margin of 42%, down from the prior 49.5%.

Technical

On the 1D chart, the share price consolidated in a descending channel formation since the gap-up from the previous earnings before a longstanding downtrend saw the share price bottom close to $56.00 before finding support. Since then, price has been trending upward, with the 50-SMA edging closer.

If the 50-SMA at $61.00 halts the upward momentum, the share price could undergo a correction. With the 200-SMA trending above the 50-SMA, the short-term momentum remains bearish, which could entice a leg down toward $57.96. The 23.6% Fibonacci retracement at $56.00 could then be a pivotal point of interest to investors, as a breakdown could catalyse a longer-term leg down toward $52.65 and $50.11.

However, a break above the 50-SMA could see the uptrend continue toward the 38.2% Fibonacci retracement at $61.75. In an attempt to push through the 200-SMA, the share price could face resistance at $64.01, with sustained upside leading to the Fibonacci midpoint at $66.40. The estimated fair value of $72.71 could then be within reach, presenting a massive 20% potential upside from current levels if the company’s fundamentals can rebound.

Fundamental

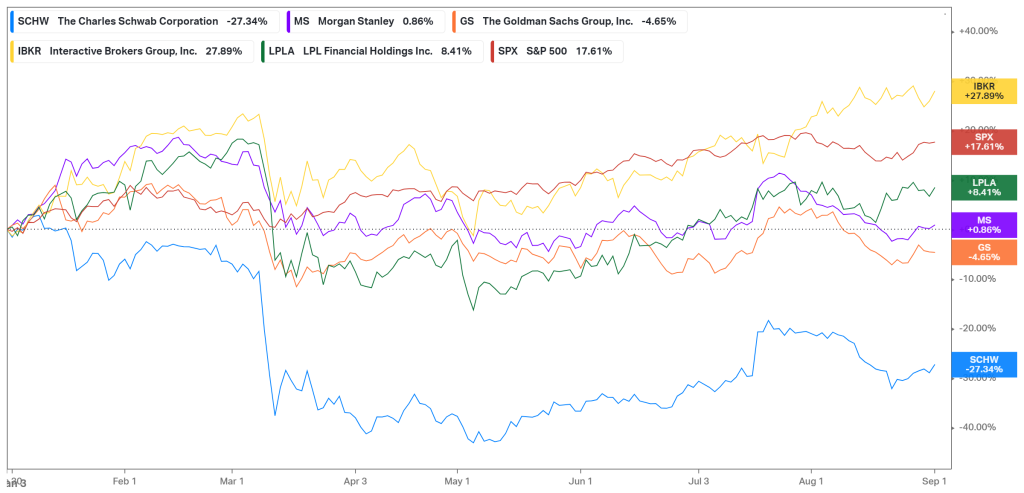

Year to date (YTD), Charles Schwab has lost over 27% of its value, initially triggered by the significant selloff during the global banking crisis earlier in the year. The company suffered a more substantial downturn than some of its industry peers, as consumers withdrew their deposits in fear of financial failure. With the company forced to seek alternative funding sources, they had to opt for a more expensive route via the Federal Home Loan Bank (FHLB). While investors had their concerns, the company recently raised $2.35Bn by selling two different tranches of bonds, consisting of $1Bn in 3-year bonds and $1.35Bn in 11-year bonds, callable after 10 years. With investors flocking in to purchase these bonds, sentiment around the company’s credit quality and financial stability has improved, signalling a potential turnaround in its fortunes.

Source: FairMarkets Australia – Koyfin, Tiaan van Aswegen

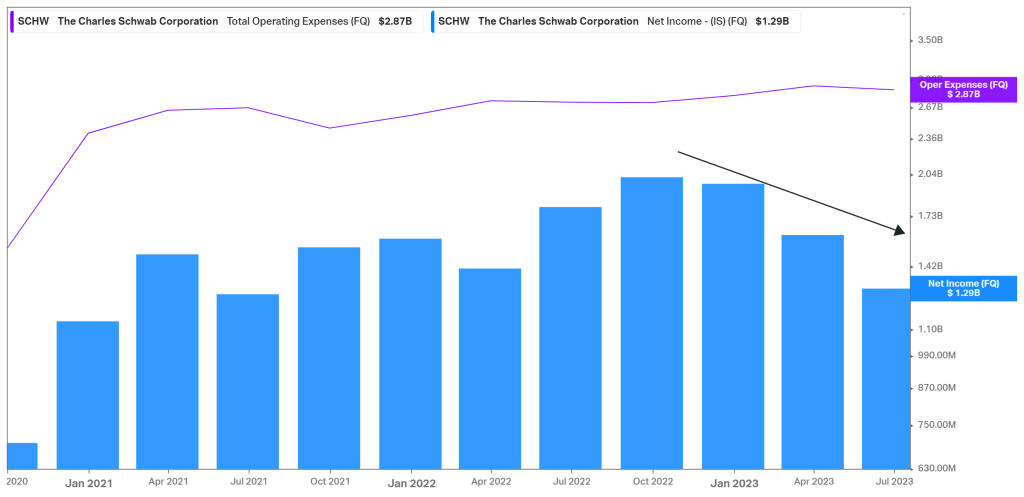

In addition to issuing these bonds for financing, the company has also revealed its cost-cutting strategy in order to reduce its operating expenditures. The graph below shows the company’s declining net income as it struggles with rising costs and expensive sources of financing. In response to that, management aims to cut costs by reducing its employee headcount and shutting down or downsizing certain offices. While a reduction in expenditure is needed, the market’s reaction was unfavourable, as it signalled further headwinds ahead, and the macroeconomic environment continued to be unfavourable.

Source: FairMarkets Australia – Koyfin, Tiaan van Aswegen

The company also recently posted its monthly activity highlights for July, which revealed a $13.7Bn base of core net new assets brought to the company by new and existing customers. Its total client assets rose 13% from the year-ago period to $8.241T, while its July new brokerage accounts were up 9% to 303K. However, the average margin balance was down 13% to $63Bn. While these metrics look optimistic, the company’s balance sheet structure requires further investigation. Regarding funding sources, its bank deposits decreased from $449.94Bn to $312.54Bn, forcing the company to raise its FHLB borrowings from zero to $48.81Bn. To put this into perspective, the interest on its bank deposits is 1.11%, while the FHLB borrowings have a 5.13% average yield. Due to its lower deposit base and higher funding costs, the company has not benefitted from the widening net interest income like most other financial institutions have. While interest revenue increased from $2.71Bn to $4.10Bn, its interest expenses rose from $166M to a whopping $1.81Bn, resulting in net interest revenue of $2.29Bn, down from the prior $2.54Bn.

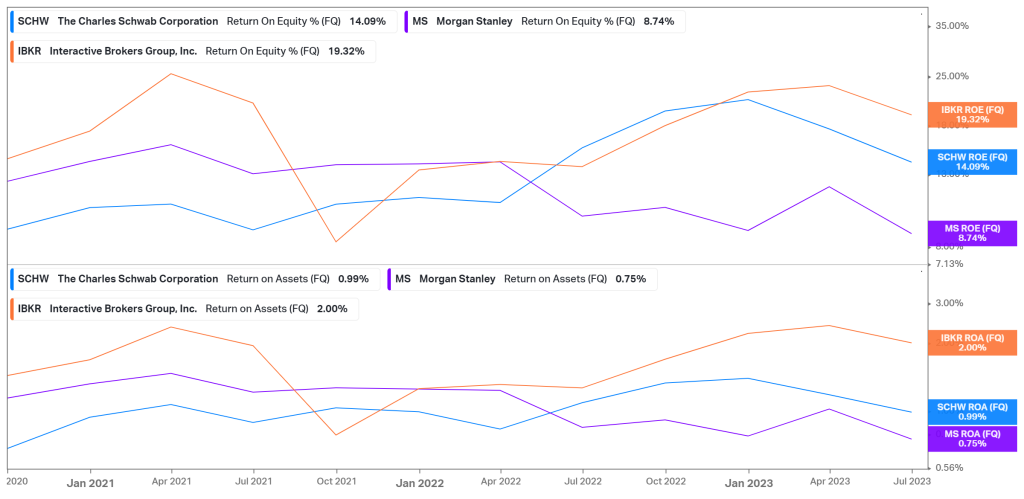

Regarding efficiency, the company falls well within the industry range. While its ROE is sitting nicely at 14.09%, there is concern that the company needs to utilise its asset base more efficiently to generate profit, considering its ROA of 0.99%, falling below 1%. As we advance, the cost-cutting strategy could efficiently boost its ROA, which could do its efficiency metrics massive favours in the future. However, it might have to see a rebound in its deposits to loan out a higher proportion of its asset base and generate additional net income at higher spreads than the expensive financing sources it currently operates with.

Source: FairMarkets Australia – Koyfin, Tiaan van Aswegen

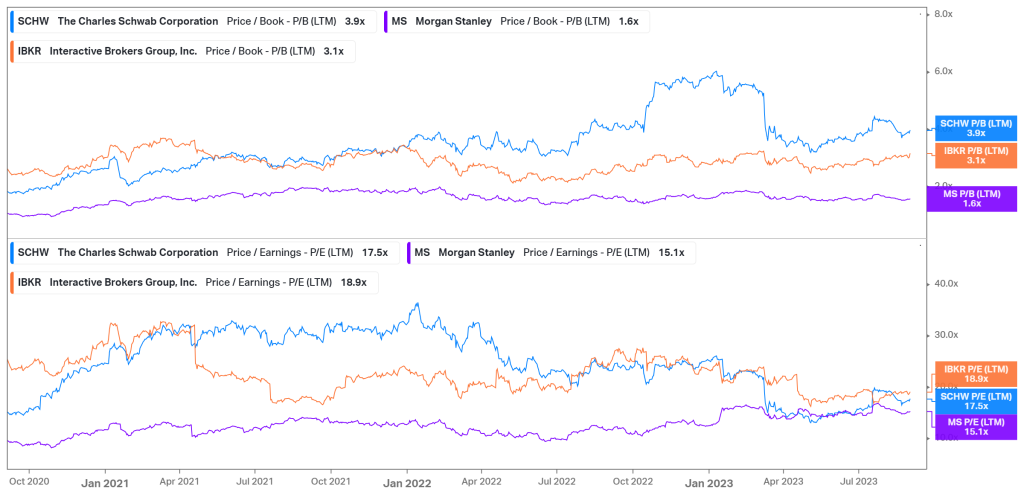

Charles Schwab is relatively well valued within the industry with a 17.5X P/E ratio, falling below the 18.9X of Interactive Brokers while edging slightly above the 15.1X of Morgan Stanley. However, its P/B of 3.9X trades well above its peers, suggesting that despite the recent sluggish share price performance, it remains relatively expensive. Whether this premium on its earnings is justified remains to be seen, as investors now look forward to the next quarterly report to gain further insights into the company’s progress of improving its profitability and efficiency in a potentially lower interest rate environment in the second half of the year.

Source: FairMarkets Australia – Koyfin, Tiaan van Aswegen

Summary

Charles Schwab has faced challenging headwinds in the current interest rate environment, forcing it to look for more expensive sources of funding that weigh on its bottom line. However, if the Federal Reserve is done with its rate hike cycle, a recovery in deposits with a successful cost-cutting strategy could trigger a turnaround in its financial performance. In that case, the estimated fair value of $72.71 presents a lucrative 20% potential upside from current levels.

Sources: Koyfin, Tradingview, Yahoo Finance, Reuters, The Charles Schwab Corporation