Deere & Company (NYSE: DE) reported impressive quarter two earnings results, with a 30% increase in sales to $17.4 billion; however, high inventory levels subdued investor sentiment. Despite inventory concerns, demand for the Company’s products remained strong, which could see future upside potential for the stock if the Company can deliver solid quarter three results.

The Company’s focus on self-driving technology in agriculture is positioning it as a game changer in the sector as it aims to introduce a fully autonomous, battery-powered electric agriculture tractor by 2026. This revolutionary technology will solve the labour market crisis in the agriculture sector and mitigate costs in the long run.

Technical

The share price traded within a descending channel pattern on the 1D chart, establishing major support and resistance at $345.81 and $445.55 per share, respectively. However, the bulls may have been encouraged to drive upward momentum as the share price intersected with the 50-day moving average, which saw the price level move out of the channel and establish resistance at $405.28.

If the $400.03 support at the 23.60% Fibonacci Retracement holds, the price level may retest the $416.78 resistance. Moreover, a break of this $416.78 level could edge the stock towards the $430.23 resistance, which may mark a pivot point towards the $445.55 major resistance, solidifying an upward trend. The fair value model presents a 7% upside potential from the current share price of $405.28 per share.

However, the MACD indicator crossing over the signal line from above may have boosted bearish sentiment, thereby encouraging a leg down towards the $400.03 support. This $400.03 support level may pose a significant barrier towards the $389.67 support at the 38.20% Fibonacci Retracement, paving the way towards the $345.81 major support.

Fundamentals

Deere & Company remains at the forefront of innovation in the agriculture industry as it plans to introduce a fully autonomous self-driving tractor in 2026, which, although pricey, will aid the lack of labour, which has been a massive issue affecting the bottom lines of companies within the industry.

The agriculture giant expects revenue growth on all fronts for the current financial year as its Production & Precision Agriculture segment is expected to see a 20% increase due to a 15% price jump. Meanwhile, Small Agriculture and Turf have projected a 5% rise in revenue due to a 9% boost in prices, and Construction and Forestry are expected to report a 15% climb in revenue due to a 10% increase in prices. The agriculture company also projects earnings for the year to be between $9.25-$9.5 billion, a 5.41% rise from its prior outlook of $8.75-$9.25 billion.

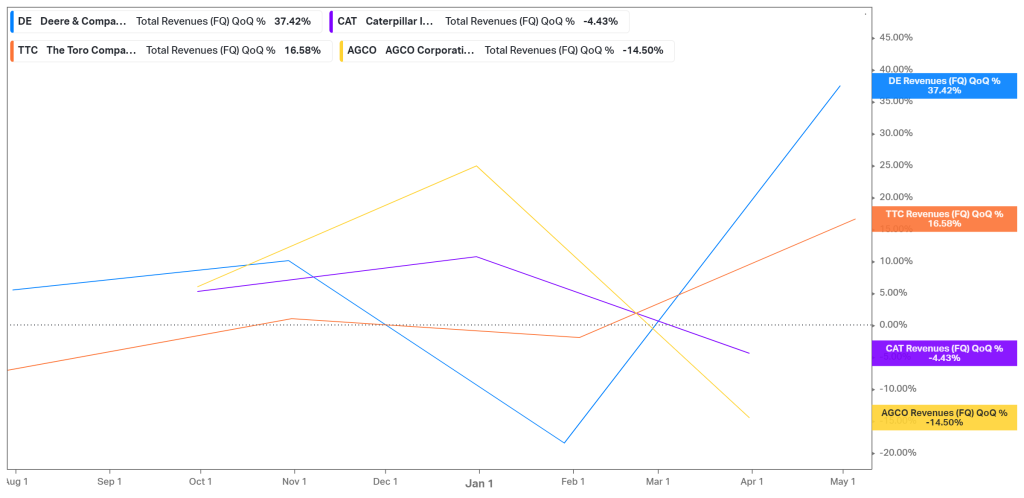

The below graph compares the quarter-to-quarter revenue of Deere & Company with that of its competitors year-to-date. Deere & Company reported revenue growth of 37.42% from the previous quarter, outperforming its closest competitor, The Toro Company, by 20.84%, while Caterpillar and AGCO reported negative growth in revenue from the previous quarter.

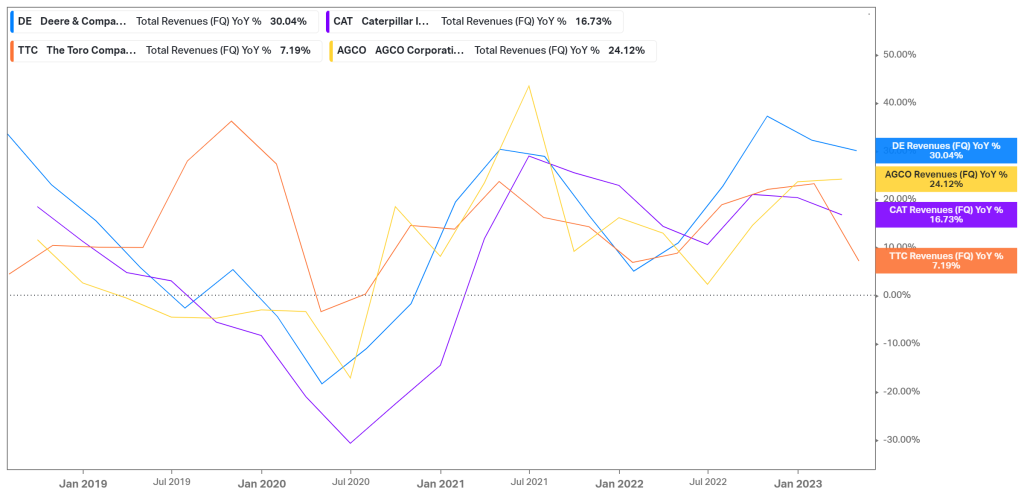

The following graph depicts the yearly revenue growth of Deere & Company with its competitors over the last five years and paints a similar picture to the graph above. Deere & Company has seen a slight contraction in its yearly revenue growth but remains ahead of its nearest competitor by 5.92%. All eyes will be on the Company’s quarter three earnings as investors will want to see if it has kept up with its above-average growth.

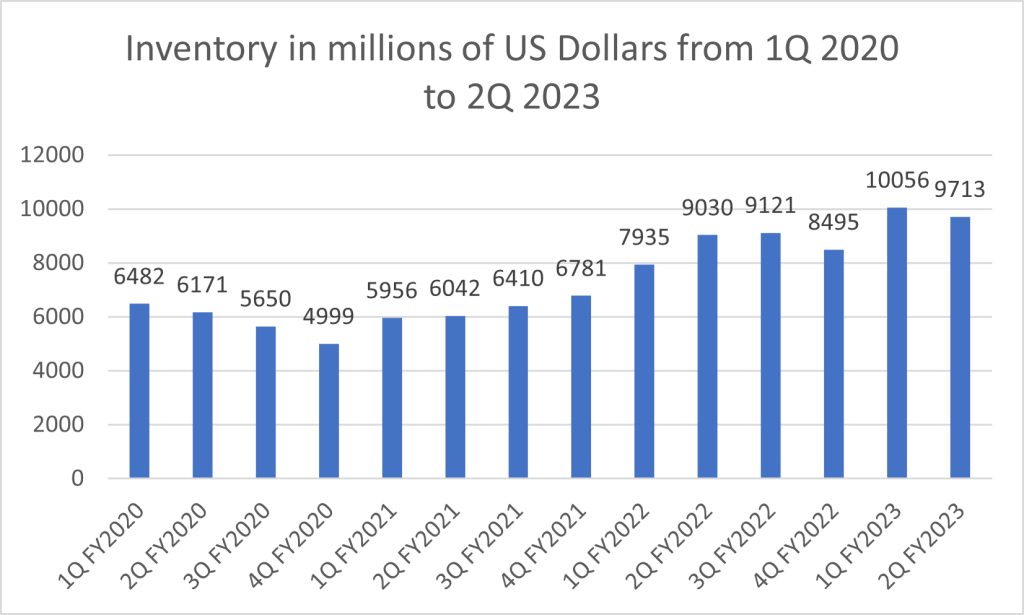

Deere & Company has been grappling with high inventory levels, which is cause for concern in the current high-cost environment as economic data releases in the US on Friday heightened recessionary fears. The agriculture giant has put the high inventory levels down to “the return to normal seasonality” in its production schedules since the low levels during all of 2022 due to labour disruptions and Covid in the years before that. However, the Company expects inventory levels to subdue throughout the course of this year, which may boost investor sentiment in the next quarter earnings if they align with expectations. The Company already saw a 3.41% decline from quarter one to quarter two of the current financial year, as seen from the graph below, exhibiting quarterly inventory levels in millions of US Dollars from the first quarter of 2020 to the second quarter of 2023.

Although Deere & Company finds itself in a cyclical industry which can cast the Company into a shadow if the agriculture sector enters into a recession, the Company has been able to sustain above-average growth and exceed expectations on multiple occasions. The Company’s total return exceeds that of the S&P500 by 27.5%, as seen by the graph below depicting the year-to-date performance of Deere & Company with the S&P.

Summary

Deere & Company remains at the forefront of the agriculture industry, reporting astounding growth from quarter one to quarter two. Favourable earnings may encourage the bulls to retest the $445.55 major resistance, thereby reversing the downward trajectory. However, economic headwinds could create a significant barrier for the bulls and pull the price level back towards the $345.81 major support, which may mark the continuation of downside momentum.

Sources: Deere & Company, TradingView, Koyfin, Craft