The Walt Disney Company (NYSE: DIS) reported its second-quarter results for fiscal 2023, hoping to send investors to dreamland on resilient financial performance. However, it was quite the opposite, as a drop in subscriber numbers sent the share price plummeting in a 5.5% pre-market loss on Thursday.

Heading into the earnings release, subscriber numbers were at the forefront. Investors also sought further clarity on the company’s move back to profitability amid a robust cost-cutting plan under CEO Bob Iger. While Disney was able to reduce their streaming losses, a reduction in subscription numbers and sobering guidance was enough to send the share price into the ground.

Technical

The 1D chart shows an ascending channel, where the pre-market selloff could result in a market opening below the channel support. The initial price action could be pivotal in determining the direction of the forward-looking trend.

If the bears continue their selloff, immediate support exists at $94.44 and $90.70. A high volume breakdown from there could lead the bears to neckline support at $84.04, where the bullish investor could look at a potential entry point.

Conversely, if the market pares the losses, the bulls could look to close the gap, where the channel support at $97.16, the 23.6% Fibonacci retracement from the mid-March low could come into play. The bulls could continue their advance, with the Fibonacci retracement levels at $101.15 and $104.38. A successful breakout from there could shift the share price out of the channel and on its way to the estimated fair value of $118.42, 17% higher than the current level.

Fundamental

Disney grew their revenue in line with expectations, with 13% growth from the prior year quarter to $21.82Bn. On the bottom line, earnings missed consensus slightly, with $0.93 per share, down from $1.08 in the same quarter last year. However, the slight bottom-line miss was hardly anything to write home about for the bears, who had their eyes set on the disappointing subscriber numbers.

Disney+ lost 4M subscribers in the first three months of the year as rising subscription costs drove users away. For the quarter, Disney+ paid subscribers were 2% lower at 157.8M, missing the 161.3M estimate. Similarly, while up 2%, the 25.3M ESPN+ missed the 25.7M consensus, while Hulu Paid subscriptions of 48.2M missed the 48.6M estimate, remaining relatively flat from the prior-year quarter. However, investors are shifting their focus away from subscriber growth toward profitability, as management implemented a $5.5Bn cost-cutting plan in the first quarter after incurring significant losses on higher content spend last year.

The shift in focus was evident in the latest quarterly results, with management finding new ways to grow average revenue per user, including price increases for their subscriptions and an ad-supported tier that is less costly to the subscriber. The average revenue per user for Disney+ in the current quarter was up 13% on a quarterly basis to $4.44. They can increase their prices as they currently have pricing room, with their Disney+ Premium subscription still 41% cheaper than Netflix’s top subscription and 31% cheaper than HBO Max on a monthly basis. However, these alternative streaming platforms do have more content available, as Disney’s management has shifted from their ‘quantity over quality’ approach to streaming content after their Direct to Consumer segment shed $4Bn last year on an estimated $33Bn of content spend.

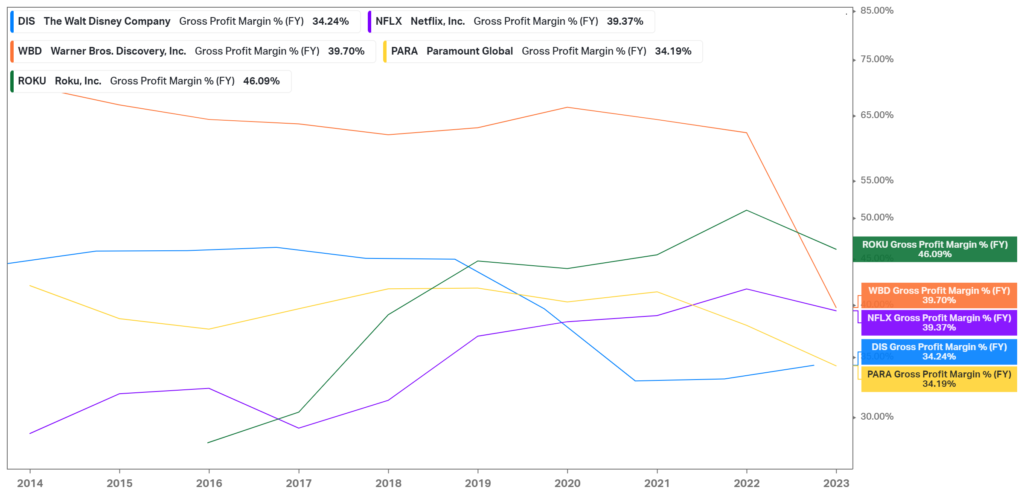

With management cutting spending on content while reducing their labour force, they have narrowed their streaming loss from $887M in the prior year period to $659M, surprising the market’s $850M loss expectation, aided by higher subscription revenue and lower marketing costs at Disney+. However, there was little optimism, as management expected this streaming loss to widen in the upcoming quarter to $800M. With the renewed focus on profitability and margins, Disney’s profit margins are worth investigating against its industry peers. It is evident that the company is struggling with higher costs and a slowdown in subscribers, as its gross profit margin has contracted significantly in recent years, making it almost the lowest ranked among its peers. Investors will keep a close eye on progress in management’s cost-cutting initiatives as we advance and the effect on its margins.

However, the company still have some positives from their quarterly results. While their Media & Entertainment segment only grew its revenue by 3% year on year to $14.04Bn, the Parks, Experiences & Product segment was up a stellar 17% to $7.78Bn on improved guest volume and spending. Furthermore, combining Hulu+ and Disney+ into a single app could aid the company in subscriber retention and advertising, further boosting its efforts to reduce streaming losses.

Summary

While the second quarterly performance was far from a fairytale for Disney investors, the company’s continuous efforts to cut costs and return to profitability are worth keeping an eye on as we advance. If management can turn around the current trajectory of their streaming business while retaining subscribers and efficiently cutting costs across the board, there could be a 17% potential upside from current levels toward the estimated fair value of $118.42.

Sources: Koyfin, Tradingview, Reuters, The Wall Street Journal, Financial Times, The Business Journals, The Walt Disney Company.