Starbucks Corporation (NASDAQ: SBUX) released their second quarterly earnings for their 2023 fiscal year, delivering a beat on their top and bottom line, as consumer demand for their popular drinks held firm despite rising prices. However, the stock took a nosedive as management reaffirmed their prior guidance, disappointing investors expecting an upgrade in the future outlook for the famous coffee retailer.

Quarterly revenue expanded 14.5% to $8.72Bn, exceeding the $8.43Bn expectations. Strong performance from all their operating segments ensured an increase in profitability, with the company reporting $0.74 earnings per share, up from $0.59 in the prior year’s quarter, while analysts were expecting a number around $0.65. With the double beat and strong performance all around, investors were concerned with management choosing not to revise its full-year guidance upward. It sent the stock plummeting to where it currently trades 6.6% lower than its pre-earnings peak. Is this contraction justified, or will the bulls quickly pounce on an attractive entry opportunity?

Technical

The 1D chart shows the company’s impressive year-to-date performance, where the bulls have recently broken out of a descending channel before the eventual peak at $115.48 leading up to the earnings. The massive gap down has started the bearish retracement process, briefly touching the Fibonacci golden ratio of 61.8% at $104.21 before advancing as the bulls look to pare the losses from the selloff.

The daily pivot point at $107.41 acts as resistance to the bulls, who look to use support from the Fibonacci midpoint at $106.31 to continue their recovery. As investors continue to process the earnings, there is a possibility to close the gap at the breakout point around $111.00, the 23.6% Fibonacci retracement. From there, the estimated fair value at $115.07 is within reach, presenting a 7.86% potential upside from current levels.

If the bears continue their retracement, a retest of the golden ratio at $104.21 and the 78.6% Fibonacci retracement at $101.23 present additional potential entry points for the bullish investor that believes in the company’s future. If the company performs in line with the disappointing guidance, short-term price pressures could further weigh the share price toward $96.96 and $93.67.

Fundamental

Investors should not take away from the positive performance metrics for the company’s second quarter. While there was a surge in supply costs and increased pressure from wage spending, the company’s outperformance was attributed to higher prices, a faster-than-expected recovery from their Chinese operations, and a more efficient quarter due to improved employee retention. Barista turnover contracted by 9% in the quarter, while the average weekly hours per Barista increased by 4%. These developments aided the company in efficiently dealing with the increased traffic in their stores, as higher prices did not deter US consumers from purchasing their drinks.

From a segmental perspective, performance was strong across the board. Comparable Store Sales in the US went up 12%, with the market expecting 8.91% growth. However, the biggest surprise came from China, as Comparable Store Sales grew by 3%, despite expectations for a close to 10% contraction. From an international perspective, 7% growth exceeded the 1.51% expectation, rounding off total Comparable Store Sales growth of 11% against the 7.3% expectation. Aiding the performance was higher pricing, trickling over into a 4% growth in the average ticket, accompanied by a 6% rise in transactions. So why would management not raise their guidance?

Several headwinds remain, starting with the tightening of global economic conditions. Consumers may reduce discretionary spending, which could drive their top line lower. Another primary concern is the uncertainty around the pace of the Chinese recovery. While there was 3% revenue growth from that region in the latest quarter, the previous quarter saw a 29% reduction in Comparable Store Sales. Management knows the recovery could be uncertain, potentially leading to choppy earnings results as we advance.

However, the future is not at all doomed. Starbucks is expanding rapidly in the new initiatives that they bring to the table. In the latest quarter, their Starbucks Rewards Loyalty App saw a 15% increase in active users, bringing the number up to 30.8M. Year on year, active members are up by 4M, as the company reported a record-breaking 57% of US revenue attributed to users of the Starbucks Rewards App. The total dollar amount that users have loaded onto the app and not spent yet came in at a stellar $1.8Bn. Furthermore, the company increased their store base by a net of 464 stores, taking the total store base to a whopping 36,634.

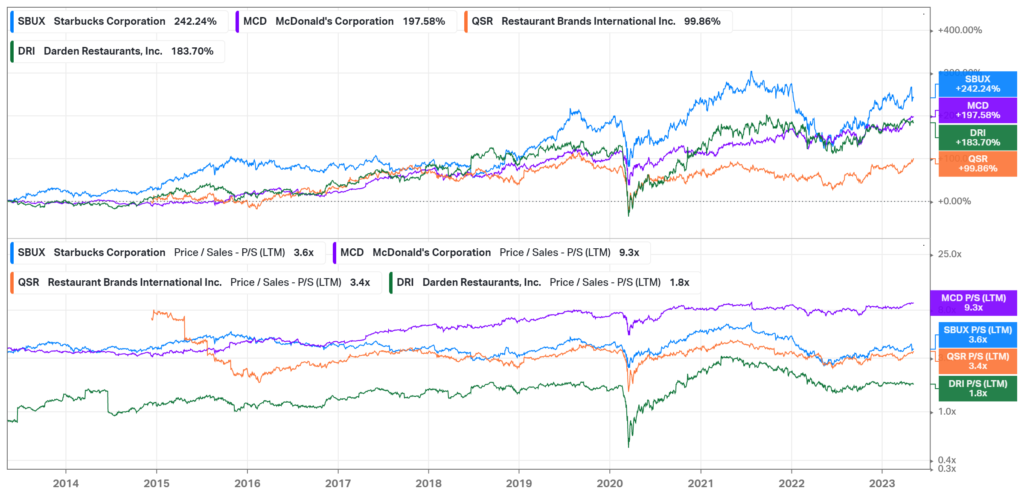

When analysing the company’s performance and valuation over the last ten years, it becomes evident that a stellar 242.24% share price performance has not made them overvalued relative to competitors on a Price/Sales basis. With the most substantial share price performance, Starbucks still operates at a relatively low P/S multiple of 3.6X, with McDonald’s operating at 9.3X, with a less attractive 197.58% price return over the same period. While Starbucks grows their share price and keeps its multiples relatively flat, investors can be confident in their sales growth resilience.

Summary

After the solid quarterly performance, management hesitated to upgrade their guidance, reflecting the macroeconomic risks ahead and uncertainty around the Chinese recovery. However, Starbucks has shown resilience in their top-line growth, with improved efficiency and employee retention aiding its bottom line. The estimated fair value of $115.07 reflects a 7.86% potential upside from current levels, with the gap down opening up potentially attractive entry points for the bullish investor.

Sources: Koyfin, Tradingview, Financial Times, TheStreet, Yahoo Finance, Reuters, Starbucks Corporation.