After several months of weak US retail data, optimism was not high leading up to first-quarter earnings from Target Corporation (NYSE: TGT). The retail industry has witnessed significant shifts in recent years, but Target has once again demonstrated its adaptability and resilience in beating estimates for the first quarter of 2023.

Target’s CEO Brian Cornell was well aware of the headwinds faced by the company in a pessimistic macroeconomic backdrop. Still, he managed to navigate the difficulties to increase guest traffic and deliver a beat on its top and bottom line. While the earnings hit the bullseye, management opted to aim lower in its forward guidance, keeping the bears in play.

Technical

The 1D chart shows a descending triangle, where a 2.58% daily gain pushed the share price to the Fibonacci midpoint from the early February peak. If the bulls continue the momentum from the earnings, the triangle resistance at $164.30 seems pretty close to reach.

However, with the company’s macro headwinds, a short-term downside could drive the share price down to the daily pivot support at $157.49. The Fibonacci golden ratio stands in the way of the bears testing the triangle support at $151.77, where a breakout could open up lower potential entry points at $149.40 and $145.04 in the long term.

The estimated fair value on a discounted cash flow basis is $176.24, presenting a 9.5% potential price upside from current levels for the bullish investor who is optimistic about the company’s growth prospects as we advance.

Fundamental

Heading into the quarter, Target’s story was relatively straightforward. Inventory growth in prior quarters and a tough macroeconomic headwind shifted investor focus onto measures the company has taken in reducing its inventories while retaining its customers who may have traded down to tighten the belt on their budgetary constraints. In the quarter, inventory was 16% lower, led by a 25% reduction in discretionary items. The company also reported 0.9% traffic growth on top of the 3.9% growth in the first quarter of last year. While digital sales took a hit, comparable store sales grew 0.7%, with analysts expecting a flat figure. Fuelling the initial optimism was a gross margin expansion to 26.3% from 25.7% despite working through their excess inventories in the highly promotional environment.

The company reported revenue of $25.32Bn for the first quarter, beating consensus with 0.5% growth. Similarly, their bottom line was stronger than the consensus at $2.05 but reflected a 6.2% decrease from the prior-year quarter. Immediately, these numbers highlight potential concerns. The graph below demonstrates the fact that Target has been struggling to expand their bottom line. With its revenue and earnings per share (EPS) growth faltering in recent quarters, they are now displaying the lowest year-on-year growth in both its top and bottom lines. Its EPS growth was once the most promising among its peers, but the recent promotional activity and slower inventory turnover have eaten into its growth.

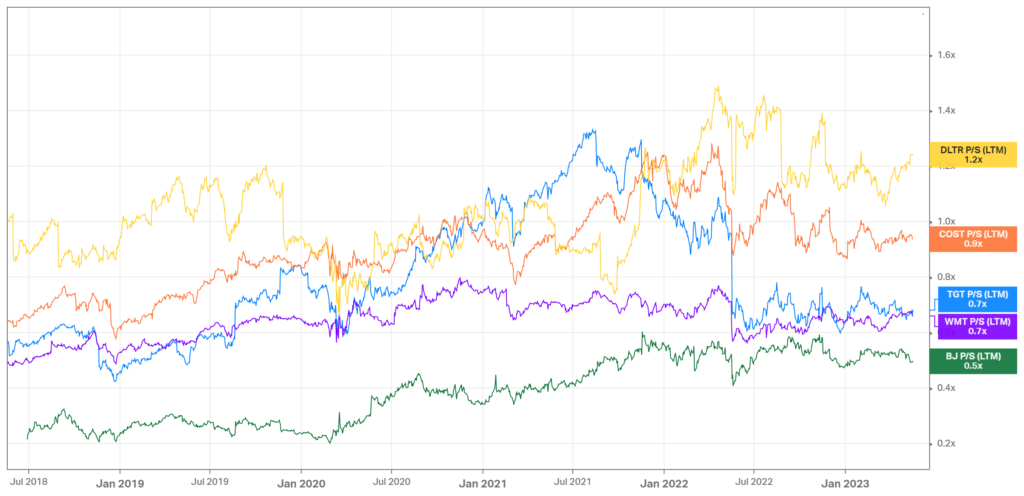

However, from a valuation perspective, the company still trades at a relatively low Price/Sales multiple of 0.7X. With Costco operating at a 0.9X multiple, Walmart and Target appear to be more rewarding at the current valuation. Still, with a measly 0.6% year-on-year revenue growth on negative earnings expansion, investors may want to see progress in cutting costs and ensuring customer retention to grow its top line before returning their confidence in the stock.

Due to the challenging consumer spending environment ahead, management guided cautiously for the upcoming quarter. Adjusted EPS was projected at $1.30-$1.70, lower than the $1.95 market expectation. At the same time, comparable sales were projected to decline in the low single digits, surprising the 0.3% expansion expectation to the downside. Additionally, management expects the ongoing inventory shrink due to theft and organised crime to eat into their profitability by a mammoth $500M in the 2023 financial year, further straining their bottom-line growth.

Summary

With consumer spending trending downward, there could be additional downside ahead for Target. While the company struggles with bottom-line expansion, it shows measly top-line growth while dealing with significant theft and inventory shrink. However, they have demonstrated resilience in navigating challenging macroeconomic environments before, and if management can execute cost-cutting initiatives efficiently while maintaining top-line growth, they could converge to the estimated fair value of $176.24.

Sources: Koyfin, Tradingview, Reuters, Yahoo Finance, Target Corporation.