WTI futures (NYMEX: CL) traders were given some fuel for thought as mixed signals from the economy probed uncertainty in the Wednesday trading session. US demand is currently at the weakest level for this time of year since 2016, while OPEC leader Saudi Arabia is set to keep its supply steady for the upcoming year. Oil traders are now becoming thirsty for a demand trigger to relieve the supply imbalance.

On the positive end, the EIA reported a 7.5M barrel reduction in inventories, with most analysts expecting an increase of 0.9 M. Furthermore, around 400 000 barrels were halted from exports as a legal dispute between Kurdish authorities and Turkey further tightened the market. Improving demand in the Asian region provides a further floor to the futures’ downside potential. As we advance, traders will monitor how the demand influx from Asia offsets the potential slowdown in other major economies.

Technical

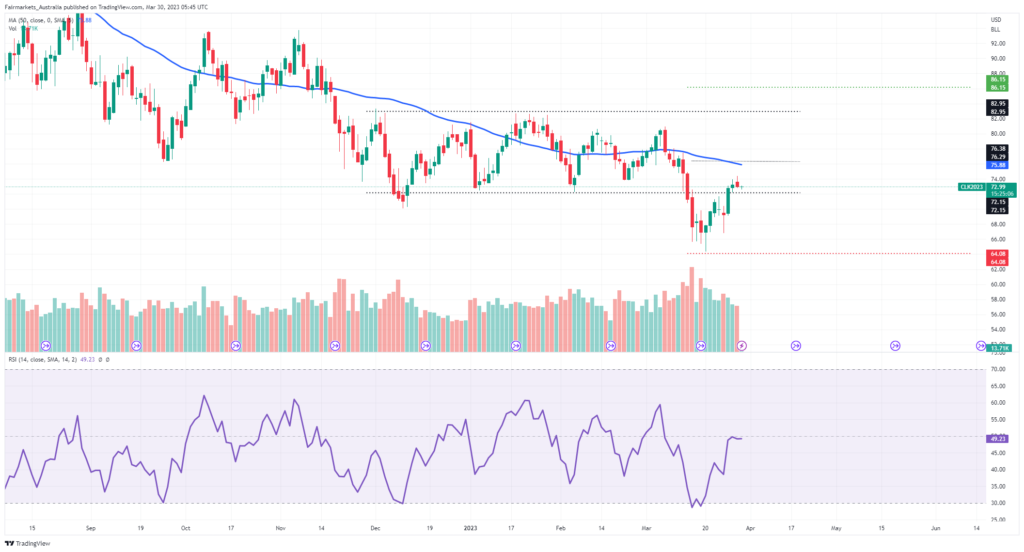

On the 1D chart, a rectangle consolidation formed between $82.95 per barrel (BLL) and $72.15 BLL, where the futures recently broke out, reaching lows close to $64.08 BLL. The breakout was not sustained, with the bulls retracing the losses back into the consolidation range. Support at $72.15 BLL could be crucial in the long-term trend. If it holds, the futures could look to test $76.29 BLL within the rectangle. On the other hand, if support fails, the futures could confirm the downside breakout and head back toward the $64.08 BLL support.

The 4H chart paints a different picture. The short-term trend is evidently bullish, with the futures trading close to the Fibonacci retracement midpoint at $72.59BLL. If the bears break through this level, they could test the uptrend support at $70.63BLL, the 38.20% Fibonacci retracement. On the other hand, if the bulls maintain the trend, they could look at the golden ratio of 61.8% at $74.55BLL.

Summary

Mixed signals in the oil market are giving traders fuel for thought. If support at $72.59BLL holds, the bulls could continue the short-term trend to test the Fibonacci golden ratio at $74.55BLL.

Sources: Koyfin, Tradingview, Reuters