Amid declining retail data and a challenging consumer spending environment, Walmart Inc (NYSE: WMT) ran up unexpected success in their first-quarter earnings of the fiscal year 2024. In a game of “Price is Right”, the retail behemoth guided with a cart full of positivity for the year ahead while cautiously keeping consumer spending expectations in the bargain bin.

Major retailers like Target and Home Depot reported earnings earlier in the week, where management referred to a slowdown in consumer spending as households started tightening the belt on their budgets while trading down to lower-cost alternatives. Walmart benefitted from the changing consumer trend, winning over high-income shoppers with their discount alternatives, resulting in a top and bottom line beat that enabled management to up their full-year guidance, despite a challenging runway ahead.

Technical

A rising wedge has formed on the 1D chart, where support exists at the wedge support at the daily pivot point of $149.84. With the problematic consumer spending environment, there could be more downside ahead, potentially leading to a wedge breakout toward support at $147.18 and $145.02. The Fibonacci golden ratio from the mid-May high at $142.87 could come into play before the neckline support is reached at $136.54.

These lower support levels could act as potential entry points for the bullish investor on the company’s outlook. The estimated fair value on a discounted cash flow basis is $160.76, presenting a 6% potential upside from current levels.

Fundamental

In their quarterly earnings, Walmart reported revenue of $152.32Bn, up 7.6% year on year in a mammoth $4.4Bn beat. Earnings per share expanded from $1.32 to $1.47 to round off solid quarterly results. Against the trend seen from other retailers like Target, the company boosted its online sales by 27%, boasting a 30% growth in advertising sales. Furthermore, comparable sales in the US expanded by 7.4%. Even though these top-line figures are impressive, the company’s focus on growing profitability over sales should be noted.

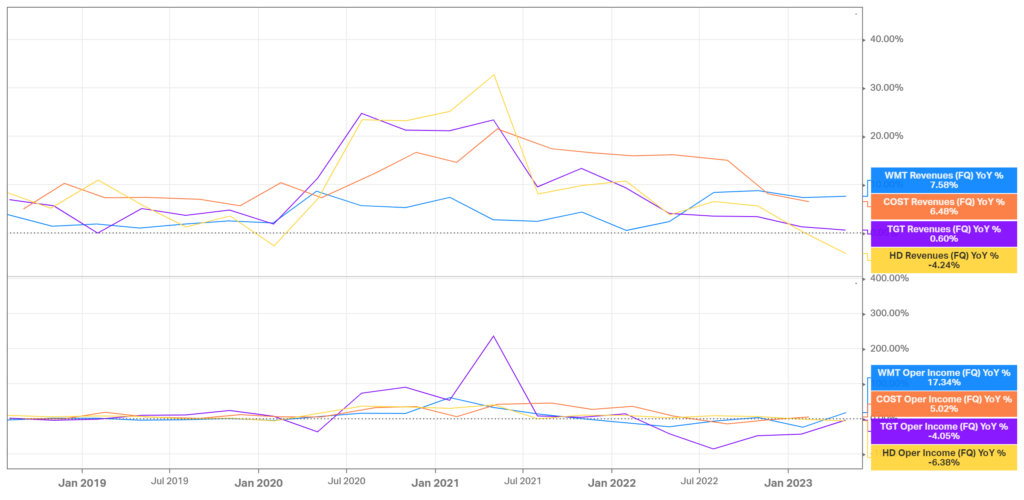

In the first quarter, operating profit was up 17.3% yearly, growing much faster than its top-line growth of 7.6%. When comparing the growth within the industry, Walmart stands out with its top and bottom-line growth exceeding that of its industry peers. This is impressive, considering they are already the largest revenue generator in the world and continue to drive its bottom-line growth at almost triple the rate of its nearest competitor on a year-on-year basis.

What aids the growth is the company’s resilient low-cost business model. While consumers are trading down to more affordable products, Walmart is ready to welcome them with open arms, as they have seen considerable growth in foot traffic as they continue to steal market share with the higher income groups. Furthermore, a higher percentage of the company’s revenue is attributed to groceries, lessening the effect of a slowdown in discretionary spending that hit other retailers like Target. In the first quarter of their 2024 year, the US segment reported a 2.9% transaction growth with a 4.4% average ticket expansion. Inventories were down 9% as the company improved its turnover, which helped them avoid significant markdowns that could eat into margins. Heading into a potential recession, these characteristics could continue to provide a tailwind for Walmart to gain additional market share at the expense of competitors more reliant on discretionary items. However, Walmart, like every other retailer, is not immune to the effects of a slowdown and will no doubt feel the pressure on its top line in the upcoming quarters.

Nevertheless, management revised their guidance upward, as they displayed confidence in the company’s ability to navigate adversity. Their full-year EPS projection now stands at $6.10-$6.26 on revenue growth of 3.5%. These figures aligned with expectations but improved from the prior guidance of EPS in the range of $5.90-$6.05 on revenue growth of 2.5%-3%.

Summary

Walmart displayed their dominance in the retail space. It reaffirmed its footing as a retail giant by posting impressive quarterly earnings results while bucking the trend in revising its guidance upward. Suppose management continues its current efforts to boost its bottom line while remaining the largest revenue generator in the world. In that case, the share price can converge with its estimated fair value of $160.76 for a 6% potential upside from current levels.

Sources: Koyfin, Tradingview, Reuters, Yahoo Finance, Walmart Inc., TheStreet