In a surprise turn of events, Zoom Video Communications, Inc (NASDAQ: ZM) has raced ahead of earnings estimates with a comfortable beat on its top and bottom line. However, with investors cautious to zoom off into the sunset of optimism, the company’s growth prospects continue to slam the brakes on the share price momentum. While the earnings result was an undeniable victory in their journey to find growth, the road ahead may not be as fast and furious as investors might hope.

First-quarter revenue for the 2024 fiscal year came in at $1.11Bn, 3% higher than the same quarter last year, while exceeding the $1.08Bn consensus. Earnings per share were close behind with growth from $1.03 to $1.16, expanding further than the $0.99 consensus. To round off the optimism, management revised their EPS guidance upward to $4.25 – $4.31 on revenue of $4.47Bn – $4.49Bn, from the prior projection of $4.11 – $4.18 on revenue of $4.44Bn – $4.46Bn. However, with corporate entities tightening their belts on budgets, can Zoom continue finding growth in a highly competitive market?

Technical

The 1D chart shows a descending channel, with the optimistic reaction post-earnings triggering a test of the channel resistance at $71.28, also the 78.6% Fibonacci retracement from the early-May bottom. The daily pivot point at $69.42 supports the bulls aiming to break through the channel in an attempt to return to the share price’s former glory.

However, with the challenging macroeconomic backdrop, the share price could experience some shorter-term downside. Multiple Fibonacci retracement levels could come into play on the potential downside move, with the 23.6% and 38.2% retracement levels at $63.80 and $60.59, respectively, which could floor the downside in a test of the channel support.

However, these levels could act as potential entry points for the bullish investor to the estimated fair value on a discounted cash flow basis at $78.91, presenting a 10.5% upside from current levels if the bulls can break through the channel resistance and complete the retracement from the early-May bottom.

Fundamental

The driver behind the resilient top-line performance was the Enterprise segment, which grew its revenue by 13% year on year to $632M. Customers in the segment were up 9% to 215,900, while the net dollar expansion rate came in at 112% on a trailing twelve-month basis. The strong Enterprise performance was enough to offset an 8% contraction in Online revenue, which came in at $473.4M. However, the net cash from operations of $418.5M declined from $526.2M, with free cash flow down to $396.7M from the previous $501.1M.

The downfall of Zoom was attributed mainly to its inability to differentiate in a highly competitive industry, with major players like Microsoft continuously stealing market share with its highly innovative product, providing customers with a comprehensive offering apart from the communication function. The concern lies in the fact that more enterprises are initiating cost-cutting alternatives, which shifts users away from Zoom toward Microsoft and its Teams offering. Zoom has attempted to rapidly increase its R&D expenses to stay afloat in the industry, but the graphs below tell a sobering story.

With new initiatives like Zoom One and Zoom Phone being implemented, the company’s R&D expenses have rapidly increased over recent quarters as they attempt to innovate their offerings and grow their customer base. However, these initiatives are not differentiated enough from what other competitors are doing; for example, Microsoft’s Phone System is very similar to Zoom Phone, which prevents significant growth in new avenues. As such, the graph below shows the rapid rise in expenses while their return on capital is rapidly decelerating. The spending on growth alternatives fails to gain traction, posing a massive headwind to future growth.

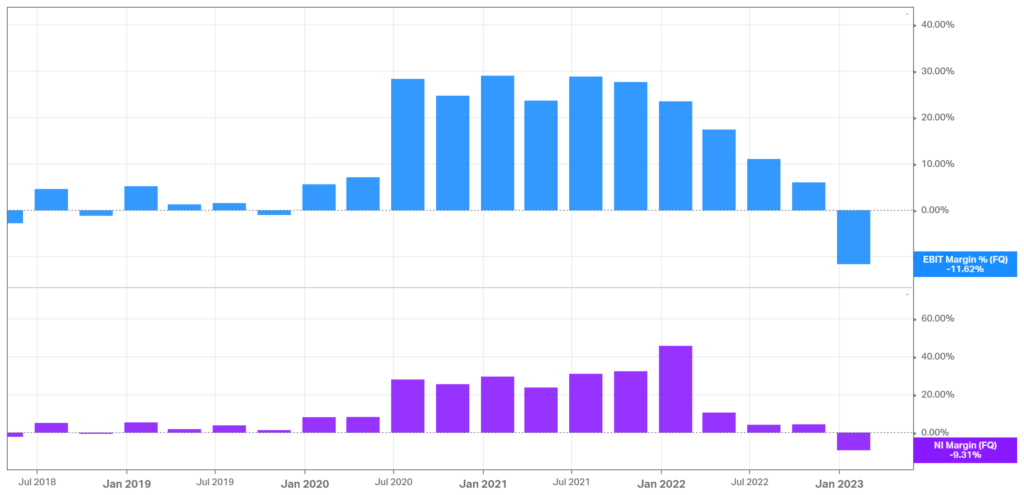

Due to the large investments in R&D with little turnover into top-line growth, the company’s margins are tightening. The graph below shows the gradual decline in both the EBIT Margin and Net Income Margin in recent quarters, with both recently shifting into negative growth territory. Unless the company’s initiatives turn over into top-line growth, its margins could remain under pressure and eat into its profitability.

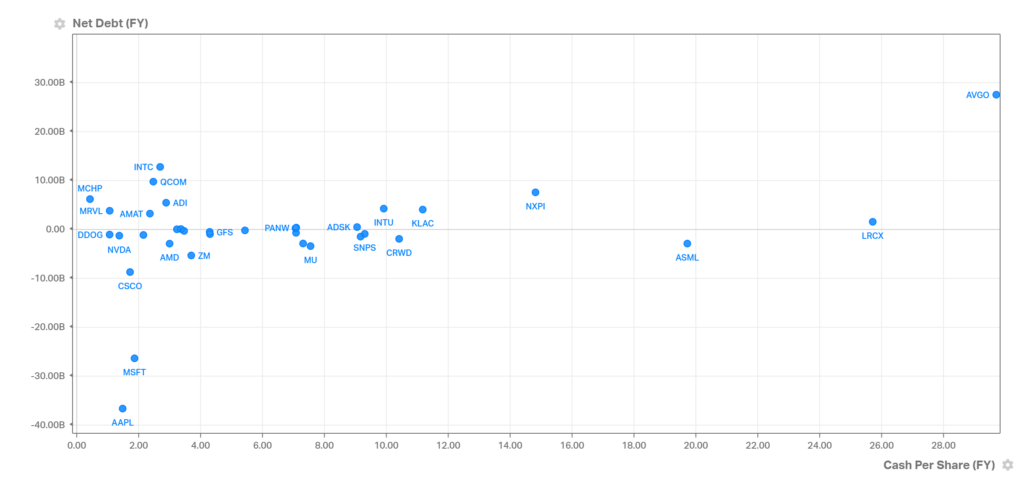

However, when looking at the company’s balance sheet, it becomes evident that they have the capacity to ramp up spending, as they are well situated in terms of having cash on hand. Zoom is more than capable of covering its debt position, opening up a large cash base that can be used for growth purposes. Even if they fail to expand their top line organically, there could be opportunities in mergers and acquisitions that the company can explore to unlock future growth. Recently, Zoom has announced an investment into AI startup, Anthropic as they look to incorporate artificial intelligence into their offerings. However, the top-line benefits remain to be seen, as yet again, Microsoft was ahead of the curve with their investment into OpenAI. The graph below shows Zoom’s position within the industry regarding cash per share to total debt.

Summary

Zoom was once at the forefront of growth in the pandemic era but has since lost its share to more differentiated competitors. While management has initiated robust spending in Research and Development, it is yet to turn over into sustainable top-line expansion. With the return to in-office working and a tightening in corporate expenditure, management has multiple headwinds to navigate. However, their investment into AI and continued efforts to differentiate their product offering could see them return to their previous glory, with an estimated fair value of $78.91.

Sources: Koyfin, Tradingview, Yahoo Finance, Reuters, Zoom Video Communications, Inc.