Investors may find themselves on the edge of their seats in anticipation of Oracle Corporation’s (NYSE: ORCL) quarter four earnings release. Following the company’s acquisition of Cerner, Oracle delved into the health sector, partnering up with major hospitals around the world, which may be a driver of the expected earnings.

An increase in earnings from $12,398 billion may showcase the company’s ability to set itself apart from competitors in the tech industry. This, coupled with the company’s divergence into enterprise AI, which may benefit businesses within various sectors worldwide, may boost investor sentiment as the company has a clear structure for integrating the software into its current platforms.

Technical

The share price of Oracle Corp. is consolidating within an ascending channel pattern in which it has managed to bounce off the upper boundary a couple of times and form a resistance at $107.22 per share, establishing an all-time high. Bullish sentiment may prevail and see the share price surpass the $107.22 per share resistance and reach new heights; however, if the current channel pattern persists, the share price may retrace towards the lower boundary before being driven back towards the upper boundary by the bulls.

The bears have managed to break out of the current channel pattern and establish support at $82.95 per share, which they may attempt again in order to reverse the current trajectory. As the share price possibly retraces towards the lower boundary of the ascending channel, bearish investors may be encouraged to drive the price out of the channel and towards the $97.83 per share support, which may mark a possible turning point.

Using the discounted cash flow model, the share’s current price of $106.47 per share offers a discount of 4.11% from the share’s fair value.

Fundamentals

Tech stocks have primarily been driven by the Artificial Intelligence Boom, which has seen the share price of companies at the forefront of AI skyrocket. However, Oracle’s focus on enterprise AI may set the software company apart from the rest. Oracle EBS (one of the software company’s major platforms) is using AI to improve sales and marketing operations by generating insights into customer behaviour, amongst other factors, leading to more effective marketing and enhanced customer service.

Since the software company acquired Cerner in June 2022, it increased its healthcare contract base by $5 billion and expects it to accelerate over the next few years. Investors may, therefore, be buzzing with excitement over the company’s release of its quarterly earnings next week as the company had said that they secured some major customers like the US Department of Defence and dozens of hospitals all over the world in its previous quarter earnings that were not accounted for.

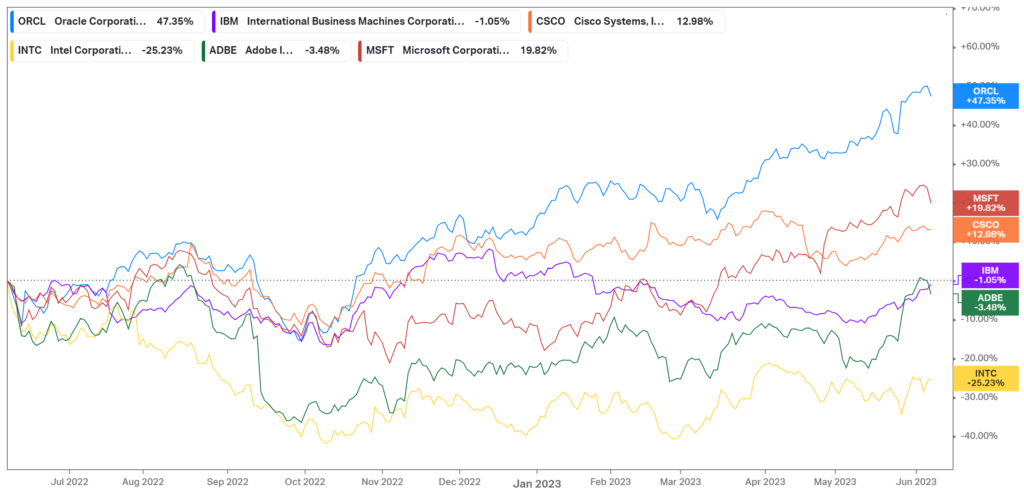

Oracle saw revenue growth from $12,275 billion to $12,398 billion quarter-to-quarter, with more than 80% of this revenue coming from the company’s cloud offerings which were up 45% from the previous quarter. The graph below compares Oracle’s total return with that of some of its major competitors over a one year period. Oracle leads over major players in the tech sector, exhibiting a 47.35% total return which is more than double Microsoft’s 19.82% and triple Cisco’s 12.98%. This abnormal return showcases Oracle’s ability to differentiate itself from its competitors by identifying gaps within the market and using its current platforms to secure them and expand.

Further exhibiting Oracle’s performance may be the graph below showcasing the company’s total return compared to the Nasdaq and S&P over the same time period. The software company has outperformed both indexes by 33.27% and 43.25%, respectively, with both indexes displaying modest returns in comparison.

Summary

With the company’s quarter-four earnings release imminent, bullish sentiment in the future prospects of Oracle could boost the share price beyond its current all-time high of $107.22 per share. However, if the earnings fall short of expectations, the bears may be encouraged to test the channel’s lower boundary and drive the share price down towards the $97.83 per share support.

Sources: Oracle Corporation, TradingView, Koyfin, Nasdaq, Craft, Gartner