Despite facing numerous industry and economic headwinds, Autodesk, Inc. (NASDAQ: ADSK) drew on its diversified end market exposure to deliver a double beat in its latest earnings report. Management was optimistic about the company’s outlook, raising the lower end of their guidance for upcoming quarters to construct a promising picture ahead of the second half of their fiscal year.

Autodesk reported net revenue of $1.35Bn, showing promising growth from the year-ago quarter’s $1.24Bn, cruising past the $1.32Bn consensus to ease some demand concerns on the company’s top line. Their bottom-line EPS grew from $1.65 to $1.91, exceeding the $1.73 forecast to round off a solid quarter across the board. Following the earnings beat and upbeat guidance, the share price rocketed, but is their current performance sustainable over the next two quarters with the economy becoming increasingly uneasy?

Technical

On the 1D chart, a golden cross formation supports the upside momentum in the medium term, with the recent breakout from the ascending channel shifting the price action above the 50-SMA. While there was a retracement in the Thursday session, the bullish momentum could persist if the 50-SMA holds off the sellers.

However, a breakdown at the 50-SMA could invite sellers to push the price action toward retesting the Fibonacci midpoint at $206.52 from the late April bottom. A further leg below the 200-SMA puts the Fibonacci golden ratio at $202.49 in the spotlight, with neckline resistance established at $197.93 and $193.39.

However, the company’s estimated fair value is $223.95, which offers a 7.38% potential upside from Thursday’s close. A leg above the $210.55 level could put the fair value within reach for convergence in the upcoming months.

Fundamental

Over the last year, Autodesk has hardly lived up to the technology rally, returning -2.35% over the last twelve months. Having to navigate headwinds in the commercial real estate sector and recession concerns pressuring the demand for their software offerings, investors have been cautious over the near-term outlook. Without clear artificial intelligence monetization opportunities, they have not participated in the year-to-date rally that has boosted the Nasdaq 100 to a 15.02% one-year return. They have also underperformed relative to their industry peers, which could either be seen as a warning sign over investor unwillingness to push the price higher or as an opportunity to buy into long-term growth at a potentially cheaper valuation.

Source: FairMarkets Australia – Koyfin, Tiaan van Aswegen

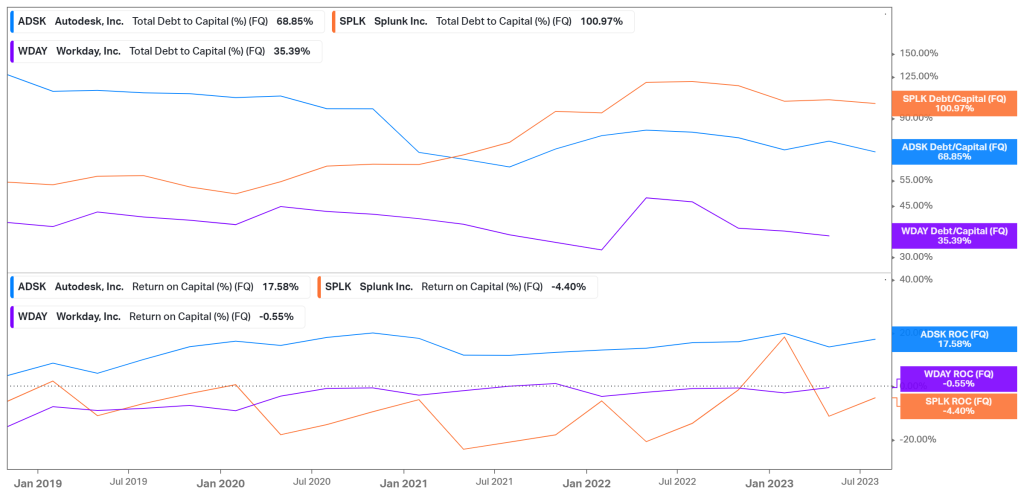

One of the company’s strengths is its efficient management of its capital structure. Looking at its leverage and liquidity, the company operates with a debt/capital ratio of 68.85%. While this represents a healthy amount of debt, it operates nicely in the industry’s mid-range while efficiently using this debt to create value. Its return on capital is sitting at 17.58%, much higher than the -0.55% of Workday and the -4.40% of Splunk.

Source: FairMarkets Australia – Koyfin, Tiaan van Aswegen

From a top-line perspective, net revenue for the quarter was up 9% at $1.35Bn, with management attributing the solid performance to a rise in early enterprise renewal rates and a more favourable foreign exchange environment. From Architecture, Engineering, and Construction (AEC), the company generated $627M in revenue, an 11% expansion from the prior fiscal year. AutoCAD and AutoCAD LT contributed $364M in revenue, up 6%, while its Manufacturing segment delivered $256M in revenue, also expanding by 6%. On a smaller scale, Media & Entertainment (M&E) advanced by 4% to $74M, while “Other” revenue came in at $24M, up by an impressive 50%. Looking ahead, management cited a massive backlog of demand, which could roll over into additional revenue growth in upcoming quarters, enticing a guidance upgrade on their top line. For the third quarter of fiscal 2024, management now expects revenue of $1.38Bn – $1.4Bn, slightly exceeding the market’s consensus of $1.38Bn. As a result, the bottom line is expected to expand within the range of $1.97 – $2.03, exceeding the market’s $1.92 forecast. However, while revenue remains strong, the graph below shows a sharp drop in free cash flows, which amounted to only $128M in the latest quarter. To continue investing in growth avenues and return value to its shareholders, this figure needs improvement in the upcoming quarters, especially considering the point made above. Without generating sufficient cash flows, the company may have to take on additional debt, which may distort its current structure.

Source: FairMarkets Australia – Koyfin, Tiaan van Aswegen

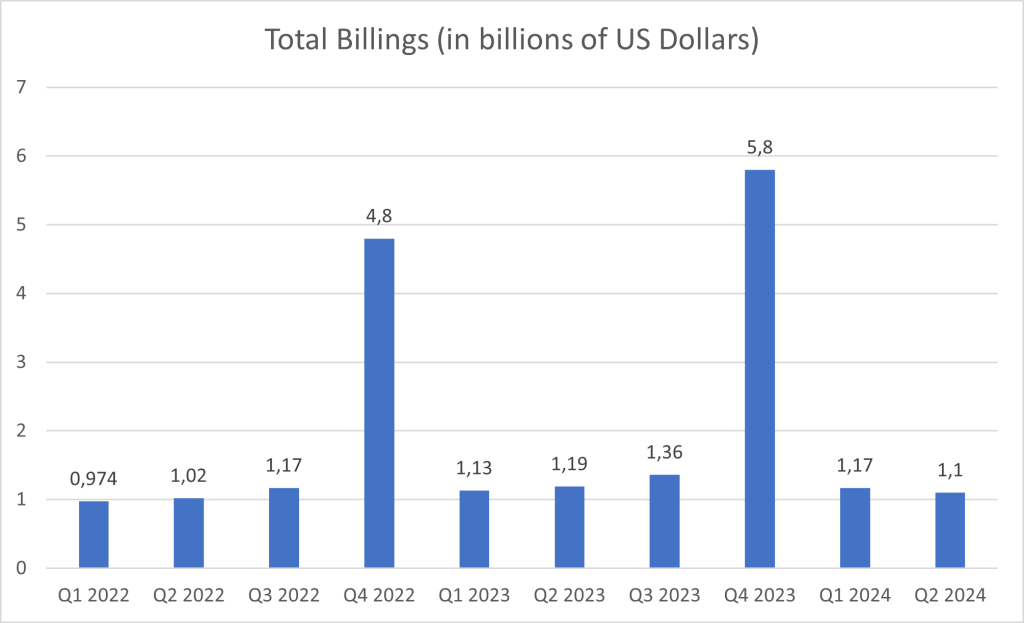

With over 4M paid subscribers across 180 countries, there was a heavy focus placed on the company’s shift away from upfront billings to annual billings, as this was the first quarter where these effects could be seen. The graph below shows the sharp reduction in the company’s billings. With billings reflecting revenue plus the net change in deferred revenue, this figure can be viewed from two aspects. Firstly, as previously mentioned, total revenue has increased from the prior quarter and year over year. Therefore, the reduction in billings was caused by an adverse movement in deferred revenue, which amounted to $4.23Bn in the latest quarter. From $4.48Bn in Q1, the reduction in deferred revenue reflects a decrease in liabilities on the company’s balance sheet. However, it can also indicate reduced demand, as fewer customers entered into contracts with them, effectively reducing its deferred revenue intake. So, while revenue is increasing, monitoring billings to indicate future demand would be worthwhile.

Source: FairMarkets Australia – Autodesk, Inc., Tiaan van Aswegen

In terms of valuation, Autodesk remains relatively overvalued on an EV/EBITDA basis at 37.6X. However, when factoring in its growth prospects, its valuation falls dramatically to a PEG ratio of 2.38. This places them relatively well in the industry, suggesting that the current price is relatively low for the growth potential inherent in the company’s earnings. With a diversified customer base and a large proportion of their top line coming from recurring revenue, their top line has been stable, and with a healthy return on capital, they have been efficiently allocating their capital to create value. Therefore, it is up to the investor’s discretion whether these characteristics and growth prospects justify the high current valuation or whether it is worth taking a bet on the long-term growth prospects.

Source: FairMarkets Australia – Koyfin, Tiaan van Aswegen

Summary

After delivering a double beat in its latest earnings report, Autodesk looks well-positioned to benefit from the digitization momentum within the construction industry. With a diversified customer base and stable revenue, the company is well-armed to face the headwinds in the broader macroeconomic environment. If management can maintain the current stability and unlock incremental growth, the estimated fair value of $223.95 presents a 7.38% potential upside for the bullish investor.

Sources: Koyfin, Tradingview, Yahoo Finance, Barrons, Autodesk, Inc.