In their latest quarterly report, Caterpillar Inc (NYSE: CAT) topped estimates in a dominating display of their financial prowess. Riding high on the surge in infrastructure demand, this construction giant has turned its economic moat into an unstoppable fortress of profit. With their pricing power cranked up to full throttle, they’ve not only delivered a top and bottom line beat but also laid the groundwork for a thriving future.

Caterpillar expanded its revenue by an impressive 22%, generating $17.32Bn in the latest quarter against the $16.53Bn consensus. On this top-line beat, their earnings per share rapidly expanded from $3.18 to $5.55, smashing the $4.58 forecast. While the increased demand in industrial spending boosted their performance, management did warn of a potential sequential slowdown in the upcoming quarter. However, their outlook remains strong, with year-over-year growth in the pipeline in the year’s second half.

Technical

On the 1D chart, a rising wedge has formed, but the positive reaction to the earnings triggered a break above the dynamic resistance. With the daily pivot point at $264.01 providing support, more upside could be on the cards in the medium term.

However, if a retracement occurs for a breakdown at the pivot, the rising wedge support could be vulnerable. Lower support exists at $237.59 if the wedge breaks down, which could trigger a trend reversal below the 50-day moving average. In the longer term, the $223.60 and $210.79 support levels could be potential interest levels for bullish investors.

On the contrary, if the upside momentum continues, the resistance at $303.72 could be tested soon. A sustainable break above could be the catalyst for convergence, with the estimated fair value at $311.08, presenting another 7.65% potential upside from current levels.

Fundamental

Caterpillar has performed exceptionally well over the last year. The industrial sector is generally quite sensitive to the economic cycle, and Caterpillar has fully taken part in the bull run of the equity market in the opening half of 2023. With a 45.6% return over the latest twelve months, they outperform not only Deere & Company (26.30%) but the broader industrial sector (15.80%), the S&P 500 (10.81%), and the Dow Jones Industrial Average (8.48%). So, what is the secret behind their success in the recent year?

Source: FairMarkets Australia – Koyfin, Tiaan van Aswegen

A lot of the optimism centres around the company’s strong positioning within the industry. As the world’s leading heavy equipment and machinery manufacturer, they boast an impressive top line. Their latest quarter was no exception, with growth realized across the board. Revenue from Construction Industries was up 19% to $7.15Bn, while Energy & Transportation grew 27% to $7.22Bn. The Resource Industries segment followed closely with 20% growth toward $3.56Bn, rounding off a solid sales quarter. Higher spending on construction equipment has been a tailwind in recent months, as Joe Biden’s $1T infrastructure bill passed in 2021 continues to provide benefits to the manufacturer. However, its ability to grow its earnings in a rising cost environment sets the company apart due to its significant pricing power. Rising material and freight costs have recently been significant industry hurdles, with supply chain issues pressuring the bottom line. As seen in the graph below, the company’s earnings growth has kept up with its revenue expansion, reflecting its strong positioning in the industry due to its ability to pass these costs onto consumers without sacrificing volumes.

Source: FairMarkets Australia – Koyfin, Tiaan van Aswegen

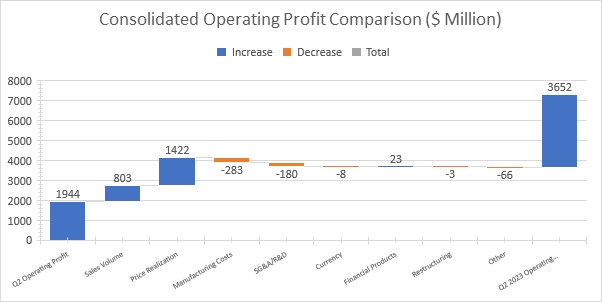

The effect of these rising prices being shifted onto consumers has effectively driven top-line expansion, as shown below. Over the last year, price realization attributed $1.42Bn of their sales growth, cancelling out the adverse currency movements. Despite these price increases, sales volumes have also crept up, suggesting that the demand for their machinery remains strong. Additionally, their order backlog increased in the latest quarter, reflecting strong future demand in upcoming quarters.

Source: FairMarkets Australia – Caterpillar, Inc., Tiaan van Aswegen

A similar effect can be seen in their earnings. While manufacturing costs and R&D had an adverse effect of $283M and $180M over the latest twelve months, favourable price realization has resulted in a $1.42B increase in earnings, with higher volumes assisting with a further $803M rise. The successful passing of these costs has immensely contributed to the company’s impressive profitability. In the latest quarter, operating costs increased from $12.3Bn to $13.67Bn, but their operating margin significantly widened from 13.6% to 21.1%. Strong top-line growth and an efficient bottom-line expansion caused the market reaction to push the share price to its all-time high.

Source: FairMarkets Australia – Caterpillar, Inc., Tiaan van Aswegen

One concern from the earnings release was the bigger-than-expected slowdown in Chinese activity. Revenue from China generally contributes 5%-10% of the company’s revenue, and the company has cautioned on weakened demand from this region. However, 32% revenue growth from North America more than offset the decline as the company continues to realize healthy demand from its key operating geographies.

On top of their healthy revenue and earnings, which sparked a surge in the company’s share price return, shareholders were also awarded $2Bn that was returned through dividends and buybacks. Caterpillar is well-known for its dividend-paying ability and has managed to increase its dividend per share by 51% since May 2019. Their dividend-paying ability is reiterated through their healthy balance sheet, as depicted below. The company is exceptionally well-positioned within the industrial sector with a large cash base relative to its long-term debt. By generating healthy free cash flows and covering its debt position with cash, the company has opened up a large pool of available funds to distribute to its shareholders.

Source: FairMarkets Australia – Koyfin, Tiaan van Aswegen

With its competitive positioning in the market and strong share price performance over the last year, the company is expected to trade at a premium relative to some competitors who do not possess the same economic moat. This fact is shown with its EV/EBITDA ratio below, which trades at 13.3X, sharing the top spot in the industry with Deere & Company. With its share price at an all-time high, there has been speculation on its valuation becoming stretched. Still, if the recent quarterly report taught us anything, it’s that Caterpillar has built an empire in the industry, using their pricing power to grow profitability in the face of rising costs. Whether their results and outlook are enough to justify the slight premium in their share price remains up to the investor’s discretion.

Source: FairMarkets Australia – Koyfin, Tiaan van Aswegen

Summary

Caterpillar has once again shown its status as the leader in the industrial sector with a quarterly report that surprised even the most optimistic of analysts. As they continue to leverage their economic moat in generating strong profits in the face of rising costs, their business looks strong in its capacity to navigate economic difficulties. With an estimated fair value of $311.08, the share price presents a 7.65% potential upside from current levels.

Sources: Koyfin, Tradingview, Reuters, TheStreet, Caterpillar Inc.