On Thursday, Ford Motor Company (NYSE: F) released its second-quarter earnings for fiscal 2023, exceeding estimates with solid performance across its traditional segments. However, the reaction from the market remained modest, as the company stalled in its electric vehicle (EV) segment. With losses widening amid an ongoing price war in the industry, management geared down its production targets, capping the optimism of its otherwise solid performance, as investors fear they are falling behind in the race toward EV market share.

Earnings per share (EPS) for the quarter was up 6%, coming in at $0.72, as the company grew its revenue by 12% year over year to $44.95Bn. These metrics exceeded the EPS consensus of $0.54 on revenue of $41.32Bn, as the company benefitted from an improved supply chain and higher industry volumes to grow its top line. However, headwinds remain in the EV segment, as management signalled a reduced pace in near-term adoption, which forced them to push out their 600,000 global EV production run rate from 2023 to 2024. Despite this, the company revised its EBIT guidance upward from $9Bn – $11Bn to $11Bn-$12Bn, reflecting an improvement in industry conditions. With these mixed results, the market reaction was unsure, leaving the price action relatively flat in the Thursday session.

Technical

On the 1D chart, the price action has broken the uptrend, starting its retracement journey where it now meets the daily pivot resistance at $13.65, where it converges with the 50-day moving average. While the market resisted the $13.84 resistance at the 38.2% Fibonacci retracement from the early-July peak, there is room for additional potential downside.

A breakdown at the psychological pivot support of $13.65 could lead the price to immediate support at $13.36, the Fibonacci midpoint. Lower support at $13.10 stands in the way of a test at the Fibonacci golden ratio of $12.87. This could be a psychological level of support, where a potential trend reversal could occur, making it a level of interest for potential bullish investors.

If the pivot support at $13.65 holds, the price could remain above the 50-day moving average to retest higher resistance at $14.60 and $15.42. From there, the estimated fair value of $16.05 is within reach, presenting a 16.8% potential upside from current levels.

Fundamental

The automotive industry, particularly the EV segment, has been topical in recent months, as Tesla CEO Elon Musk engaged in aggressive price cuts to stimulate demand in a tight discretionary environment. As a result, other EV producers had to react with their own cuts, focusing on margins, with input costs remaining high. Since then, Tesla has grown their deliveries to record levels, emphasising volumes rather than profitability. On the other hand, Ford is less sensitive to the EV market, as their biggest segment remains their internal combustion engine (ICE) vehicles. While the discretionary sector as a whole has faced headwinds from tighter consumer spending, the development of artificial intelligence and its application to the EV industry has provided a tailwind of optimism for companies like Tesla, explaining their 107.59% year-to-date (YTD) performance. While Ford had little room to ride this wave, their YTD performance has been lacklustre when compared to Tesla and BYD Company, as their 18.06% return is in line with the S&P 500 (18.18%). However, an 18% expansion in the opening half of the year in challenging economic conditions remains impressive, and with conditions improving, there could be more upside on the cards following their latest earnings beat.

Source: FairMarkets Australia – Koyfin, Tiaan van Aswegen

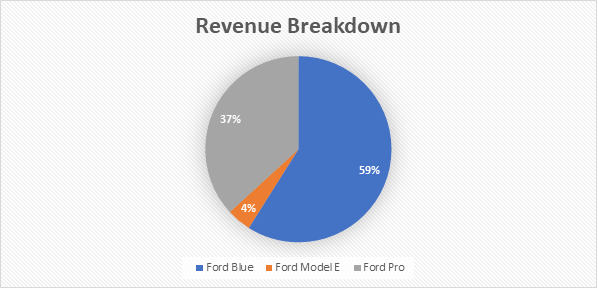

The revenue breakdown below depicts Ford’s continuous reliance on its traditional Ford Blue segment, which contributed 59% of total revenue in the latest quarter, while its Ford Pro commercial segment makes up the bulk of the remainder. The EV segment, Ford Model E, contributed only 4% of revenues in the latest quarter, with the company struggling to expand at the expected rate. In the second quarter, Ford Blue boosted its volume by 7%, remaining profitable with $2.3Bn in EBIT at an EBIT margin of 9.2%. Its Ford Pro division was the stand-out performer with an 8% rise in volume, generating more than double the earnings from the year-ago period at $2.4Bn in EBIT, with an EBIT margin of 15.3%. However, the Ford Model E segment widened its losses from $0.5Bn in the second quarter of 2022 to $1.1Bn. At the same time, their EBIT margin in this segment is unsurprisingly under immense pressure at -58.9%.

Due to the small proportion of the business relying on its EV segment, the total margins would not have been as adversely affected by the price cuts as other competitors like Tesla, who are fully emerged in the EV space. However, their Net Income Margin (4.24%) and Gross Profit Margin (10.93%) remain below their peers’ margins. With lower profitability and slow progress in the EV space, the company may need to find ways to reduce its input costs for margin expansion in the upcoming quarters to remain competitive in the industry.

Source: FairMarkets Australia – Koyfin, Tiaan van Aswegen

While the EV division was expected to become their main revenue growth driver in the long term, management has decided to slow the production ramp-up in this loss-making segment in order to shift additional investment into its commercial segment, Ford Pro. As a result, the 600,000 global EV run rate that was previously expected for 2023 has been pushed out to 2024. The shift away from its loss-making segment might be savvy, but the company has a cash-rich balance sheet, with $10.3Bn in cash net of debt, while generating $2.9Bn in adjusted free cash flow, which allows them to absorb the medium-term losses if it can unlock growth in the longer-term. Therefore, it remains to be seen whether this decision would benefit the company in the longer term, as the EV market, although very competitive, holds real opportunities for growth.

Summary

While Ford reported a double beat in earnings for their latest quarter and revised their guidance upward for the full-year, concern about the growth in their EV sector remains a headwind as we advance. The recent shift in strategy away from investment into their EV segment toward their more profitable divisions could benefit them in the shorter term but could weigh on their long-term prospects in the EV segment. However, with an estimated fair value of $16.05, the share price presents a 16.8% potential upside from current levels.

Sources: Koyfin, Tradingview, Reuters, Investor’s Business Daily, Ford Motor Company