Zoom Video Communications (NASDAQ: ZM) has been the victim of intense scrutiny since its Covid-induced boom, with investors selling off the stock that has failed to keep up with the ever-changing consumer needs in a highly competitive industry. After losing most of its value since the pandemic, investors are zooming in on the company’s growth potential, and while the latest quarter exceeded operational expectations, its outlook might not be as rosy.

Revenue for the quarter jumped 3.6% from the year-ago quarter to $1.14Bn, slipping past the $1.11Bn consensus in an optimistic top-line result. On this revenue, Zoom generated $1.34 in earnings per share (EPS), with their recent cost-cutting initiatives aiding a bottom-line expansion above the $1.06 consensus from the prior $1.05. While the share price edged up 1.48% on the release day, a tug of war has broken out between optimistic buyers and those who believe the company’s glory days may be behind them.

Technical

On the 1D chart, the market hesitated at a psychological resistance, causing a selloff in a descending channel that found support at $64.39. From there, the price pushed through the 50-SMA, signalling a potential momentum reversal to the upside following the earnings.

However, the 50-SMA remains below the 200-SMA, which could entice the sellers to push the price down. Currently, at the $67.69 resistance level, another pullback is on the cards, potentially reaching $64.39 again. Neckline resistance exists at $62.47 and $60.81 in the longer term if the downside momentum continues.

However, a push above $67.70 could result in an upside continuation to challenge the 50-SMA. The estimated fair value of $74.94 could then be within reach, offering investors a 10.76% potential upside from current levels.

Fundamental

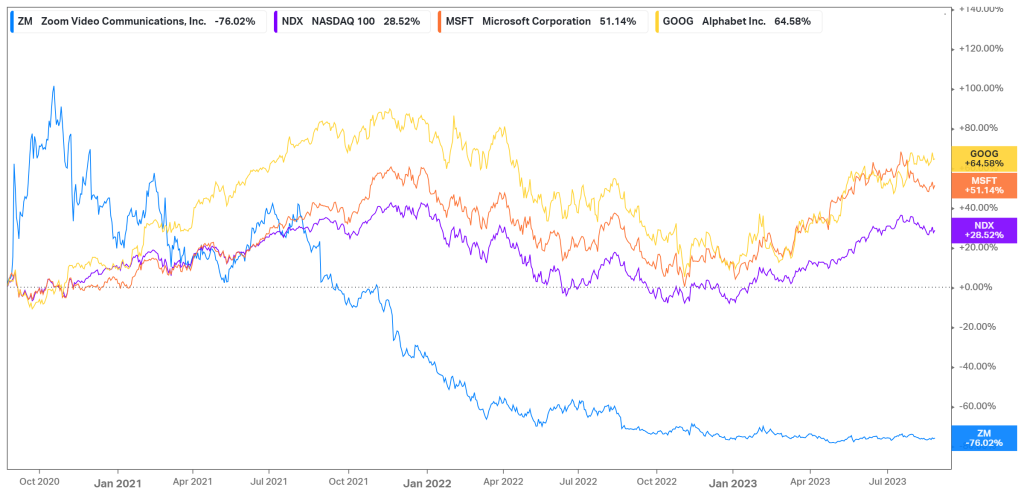

Over the last three years, Zoom has returned -76.02%, as its prospects for future expansion dwindled. After a surge in demand caused by the shift to working from home, there was a major correction, as the company lost customers and failed to keep up with the innovation of its competitors. Microsoft introduced its Teams platform, while Google Meets took the market by storm, with these companies growing 51.14% and 64.58%, respectively, over the same three years. With the soft demand for its offerings in a tight macroeconomic environment, can Zoom turn things around, or are its prospects still insufficient to convince the market of its inherent value?

Source: FairMarkets Australia – Koyfin, Tiaan van Aswegen

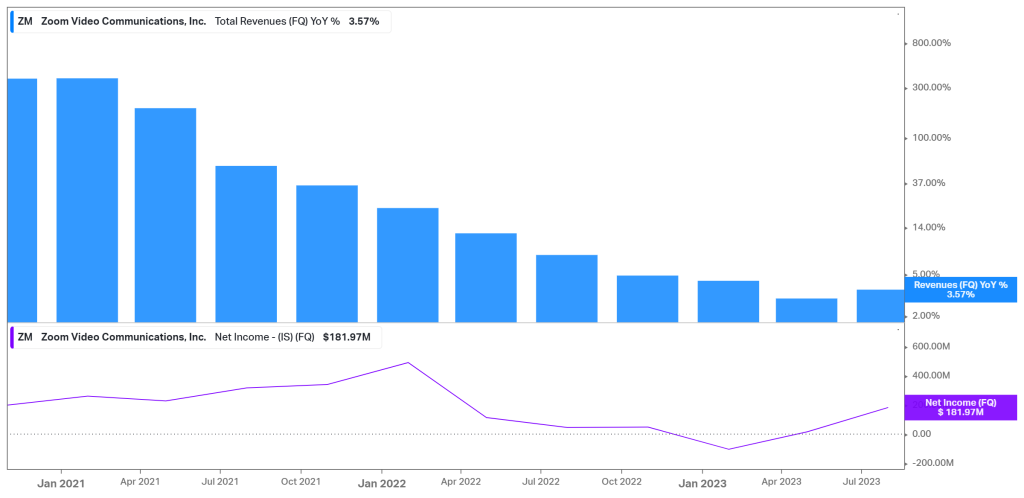

A primary concern in recent quarters has been the significant slowdown in its revenue growth, as shown in the graph below. Revenue growth has been steeped downward, stalling from nearly 300% in 2021 to a lacklustre 3.57% in the latest quarter. The recent revenue beat has enticed management to upgrade their guidance for the full fiscal year 2024. From their prior estimates of $4.47Bn – $4.49Bn, the company now expects full-year revenue to amount to $4.49Bn – $4.50Bn. However, this presents a mere 2% expansion from the previous year, signalling a continuation of the current revenue growth downtrend. On the bright side, their net income attributable to common stockholders increased sharply from $45.75M in the same quarter of 2023 to $181.97M, reflecting efficiency in its recent cost-cutting initiatives.

Source: FairMarkets Australia – Koyfin, Tiaan van Aswegen

The effect of these cost cuts, including the layoff of 15% of its workers in February, are shown in the graph below. After successive quarters of rising operating expenditures, the company has made progress in reducing these costs. As a result, its margins have undergone healthy expansion, boosting its profitability metrics. Its net income margin currently sits at 15.98%, with its EBIT margin similarly situated at 15.58%. Its gross margin for the period expanded from 75.1% to 76.6%, rounding off a solid quarter of margin expansion.

Source: FairMarkets Australia – Koyfin, Tiaan van Aswegen

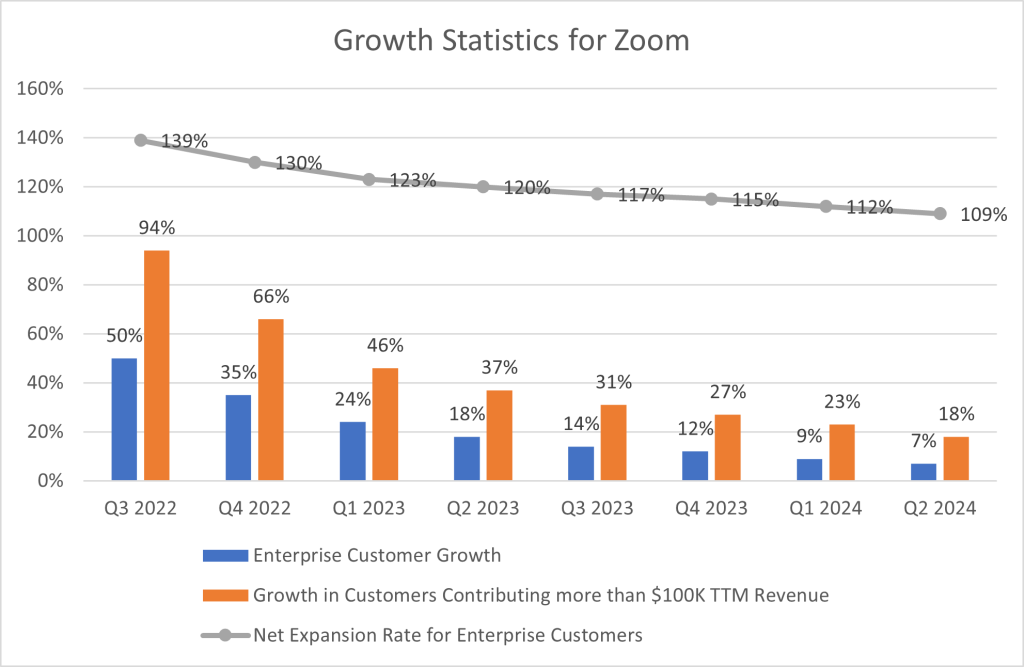

Zoom has recently shifted its business model away from consumers to focus on its enterprise segment. In the latest quarter, the enterprise segment expanded 10% to $659.5M and contributed more than half the revenue generated in the quarter. The number of enterprise customers grew 6.9% to 218,100. The number of customers contributing more than $100K in revenue on a trailing twelve-month (TTM) basis expanded by 18% to 3,672, at a TTM Net Dollar Expansion Rate of 109%. While these statistics look optimistic at face value, a strong descending trend can be seen over the last few quarters on the graph below. With customer growth slowing down, the company needed to unlock additional revenue from its existing customer base. Still, its ability to do so is declining, as shown by the net dollar expansion rate. They also have fewer customers contributing more than $100K in revenue, suggesting that the company is losing its ability to expand its customer base while failing to unlock revenue from its existing customers sustainably. This could be a major cause for concern for management going forward. Apart from the enterprise segment, Online Sales fell 4.3% to $479.2M.

Source: FairMarkets Australia – Zoom Video Communications, Tiaan van Aswegen

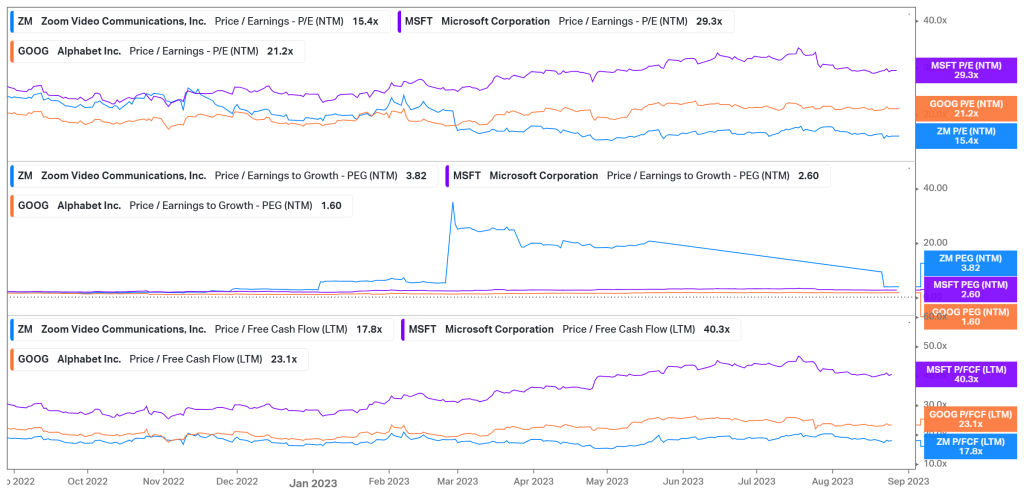

With the market unconvinced of the company’s growth prospects, its valuation has dramatically decreased to reflect these expectations. After losing 76% of its share price in three years, Zoom now operates with a P/E ratio of 15.4X and a Price/Free Cash Flow of 17.8X, making them relatively undervalued against industry players like Microsoft and Google. However, when factoring growth into the equation, Zoom’s PEG ratio of 3.82X places it higher on the valuation spectrum, signalling that while the price is currently low, it remains expensive on a comparable basis, considering its weak growth position in the industry.

Source: FairMarkets Australia – Koyfin, Tiaan van Aswegen

To get the market back on its side, Zoom will no doubt have to find a way to unlock revenue growth. Management is confident in its artificial intelligence (AI) prospects, with new capabilities of summarising and organizing meetings being integrated into its platform. Investment into these initiatives will be crucial to continue to innovatively stay in the game and keep up with the developments made by its competitors. On the bright side, the company sits with $6Bn in cash, with its free cash flow in the recent quarter expanding from $229.38M to $289.37M. With this healthy cash position and positive cash flow generating ability, the opportunity for strategic investment in growth opportunities is there, and it is now up to management to find these opportunities and monetize them into additional revenue growth to stay up to par with the industry competition.

Summary

While Zoom delivered a successful earnings report that exceeded estimates across the board, the struggling communications company is not out of the water just yet. Investors remain cautious over their revenue growth ability as we advance in the midst of intensifying competition and dwindling post-Covid demand in a challenging economy. However, with a healthy balance sheet, the opportunity for strategic investment in growth prospects is there. If management can find the right opportunities to allocate cash toward, in addition to its efficient cost-cutting initiatives, the company’s top line can follow the bottom line into expansion. In this case, convergence with the estimated fair value of $74.94 is on the cards, presenting a 10.76% potential upside from current levels.

Sources: Koyfin, Tradingview, Reuters, Yahoo Finance, Zoom Video Communications