Despite dishing out an award-winning performance in its latest quarterly report, Netflix, Inc. (NASDAQ: NFLX) could not escape a twist ending in the stock market, as its share price plummeted 8% after-market. The streaming giant delivered blockbuster earnings but fell short of its revenue forecasts while providing disappointing guidance for upcoming quarters. With a cliffhanger finale at the market open, could there be another twist in this thrilling tale?

Netflix reported earnings per share (EPS) of $3.29 on revenue of $8.18Bn, exceeding the prior year’s quarterly EPS of $3.20 on revenue of $7.97Bn. While EPS exceeded the $2.85 expectation, revenue fell short of the $8.29Bn forecast. Similarly, management guided for EPS of $3.52 in the upcoming quarter, surpassing the $3.19 forecast, while revenue guidance of $8.52Bn missed the $8.68Bn consensus to the downside. The conservative guidance sparked a selloff in after-market activity, leaving the bulls with much to do to maintain the recent uptrend.

Technical

On the 1D chart, an ascending channel has formed, with the upward trend holding firm above the 50-day moving average. However, with the after-market activity putting the channel support at risk, with an RSI indicating overbought conditions, the possibility of a pullback is on the cards.

A breakdown below $447.27 could pressure the share price, bringing the Fibonacci midpoint from the mid-June 2022 bottom back into focus at $431.23. Lower support exists at $412.98 and $381.05 if the downside momentum persists.

However, if the channel support holds, the uptrend could continue within the channel, with the daily pivot point at $467.24 acting as the first potential resistance level. The Fibonacci golden ratio is then within reach at $495.12, where a breakthrough could lead to convergence with the estimated fair value on a discounted cash flow basis at $522.55, presenting a 9.5% potential upside from Wednesday’s closing price.

Fundamental

Since the post-Covid selloff, Netflix has swiftly recovered as the share price found large amounts of buyers at relatively cheap valuations. Year to date, the stock has advanced 61%, while its performance over the last 12 months is nothing short of exemplary, returning 150.15% since August 2022. The graph below puts this performance into perspective, as the company has generated a considerable divergence from both its competitors, the S&P 500 (19.18%) and the broader consumer discretionary sector (21.83%). This brings us to the question of whether its fundamentals still reflect the strong performance as we head into the second half of the year.

Source: FairMarkets Australia – Koyfin, Tiaan van Aswegen

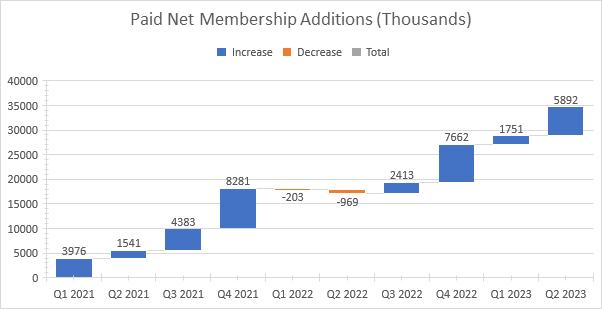

Subscriptions primarily drive Netflix, and in this quarter specifically, heavy emphasis was placed on subscriber growth as the company started implementing its password-sharing crackdown with its paid account-sharing feature in an attempt to incentivize individuals to open their own accounts, compared to sharing with friends or family. Based on the quarterly reports, the results were highly effective, as the company generated 5.89M global paid net additions, shattering the 2.3M consensus. The steady growth in subscriber additions is shown below. The company stumbled in the first half of 2022, as the post-Covid return weighed on their subscriber numbers that boomed during the lockdown era. Since then, they have done well to recover their subscription base steadily.

Source: FairMarkets Australia – Netflix, Inc., Tiaan van Aswegen

As a result, their total subscribers have risen slowly but steadily over the last ten quarters, with a few hiccups post-Covid. The latest quarter reflected 238.4M subscribers, up from 232.5M in the prior quarter. However, as the growth rate slows and competition heats up, there has been concern about the streaming market becoming saturated. With little room for expanding their subscription base, management had to look for other alternatives to drive their top line.

Source: FairMarkets Australia – Statista, Tiaan van Aswegen

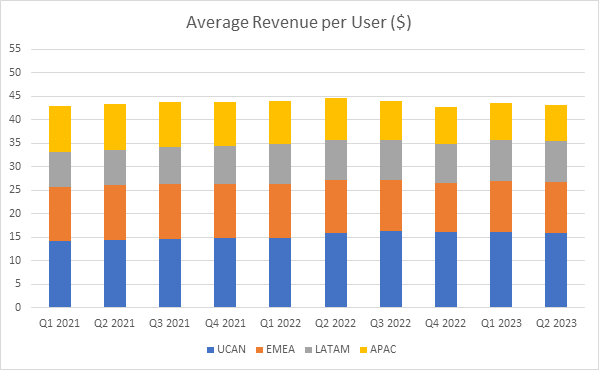

The need for a strategic change to unlock additional revenue from its existing base while attempting to lure additional subscribers is what led to the initial password crackdown initiative. Members now have to pay an additional fee to allow outside users to stream using their accounts, enticing outsiders to create their own accounts. In addition to that, the company initiated a lower-cost ad-supported plan, which is a cheaper alternative to its basic plan but includes commercials. The idea behind this strategy was to unlock additional revenue per user, as its income from the advertising section should offset the lower subscription fee in the longer term. Netflix also removed their cheapest ad-free plan in the US and UK to new users, which cost members $9.99 per month. The most affordable ad-free plan for new users will now cost $15.49 per month, which could entice an additional influx of users to its ad-supported $6.99 per month plan. So, as shown above, the company has done well in retaining its existing subscription base despite the password crackdown and smashed estimates on subscriber growth. However, there has yet to be much progress in generating additional revenue per user so far.

The graph below shows the stagnant average revenue per user (ARPU) in the recent quarter, with a lack of growth in the last ten quarters as a whole. The company attributed the slowdown to the timing of its paid sharing rollout, which only occurred in the latter half of the quarter, as well as minimal price increases in the past year and a higher portion of membership growth from lower-income countries. However, management expects revenue growth to increase as we advance, as its ad-supported tier starts picking up steam and its worldwide rollout of the paid sharing initiative takes effect. We could, however, witness a “J-Curve” type revenue growth, where the initial rollout could cause lower subscriber growth and lower revenues as some consumers could decide only to open a new account or shift to a different plan in a few months, which could result in an initial drop in revenue before the expected fast-growing expansion takes place.

Source: FairMarkets Australia – Netflix, Inc., Tiaan van Aswegen

Another topical discussion in the entertainment industry centres around the current Hollywood strike, which has halted the writing and production of a significant amount of content. While management has signalled that they are committed to reaching a deal with writers and actors to put a stop to the strikes, Netflix could be one of the best-positioned streaming companies to weather out the storm of a prolonged strike. The company is well-diversified in its geography and genres while maintaining a solid balance sheet that minimizes the potential risk. In fact, the company realized significant free cash flow growth, up from $13M in the year-ago quarter to $1.339Bn, while boosting their free cash flow forecast for the whole year north of $5Bn, due to lower cash content spend. The graph below shows the company’s debt position compared to its annual free cash flow. Evidently, Netflix has significantly lower long-term debt than Disney and Warner Bros while generating a similar amount of free cash flow, making it less levered than its competitors.

Source: FairMarkets Australia – Koyfin, Tiaan van Aswegen

Summary

In the aftermath of its latest earnings report, Netflix shares slumped as a top-line miss, and disappointing guidance left investors with a sour taste. However, with its recent pivot in strategy, we could witness a medium-term revenue stall before the implementation of the plan takes full effect, which could open a lucrative runway for growth in upcoming years. With an estimated fair value of $522.55, the share price presents a 9.5% potential upside from current levels.

Sources: Koyfin, Tradingview, Reuters, Yahoo Finance, Netflix, Inc., Statista, CNBC