On Tuesday, HP Inc. (NYSE: HPQ) delivered its third quarter report for fiscal 2023, which brought a 10.74% after-market stumble, underlining persistent PC market struggles. Beyond the revenue shortfalls, management steered earnings expectations lower for the next quarter due to a slower-than-expected external market rebound. The road ahead remains uncertain as challenges linger, forcing investors to tilt in favour of caution for the upcoming quarter.

Revenue for the quarter amounted to $13.2Bn, a 9.9% decline from the prior year’s $14.65Bn in the same quarter. While the market expected a contraction, the decline missed the $13.4Bn forecast to the downside as the company’s top-line issues persisted. HP generated earnings per share (EPS) of $0.86 on this revenue, in line with the market’s consensus, while slipping below the $1.03 generated in the same quarter last year.

Technical

On the 1D chart, recent consolidation at the top of an uptrend led to a steep selloff leading up to the earnings release. The selloff sent the share price below the 50-SMA, where the after-market losses enforced an additional leg down below the 200-SMA ahead of Wednesday’s market open.

If buyers are found at the lower end of the after-market move, the share price could correct toward resistance at $29.08 and $29.94, close to the 200-SMA. Higher resistance is established at $30.57 and $31.64 to reverse the post-earnings losses. If the share price breaks above the Fibonacci midpoint at $32.22, the estimated fair value of $33.08 could be within reach, presenting a 5.5% potential upside from Tuesday’s close.

However, further downside could persist if the gap fails to close and resistance is met at the 200-SMA. In this case, the share price could look for buyers at $27.98, where the estimated fair value presents a more lucrative 18% potential upside.

Fundamental

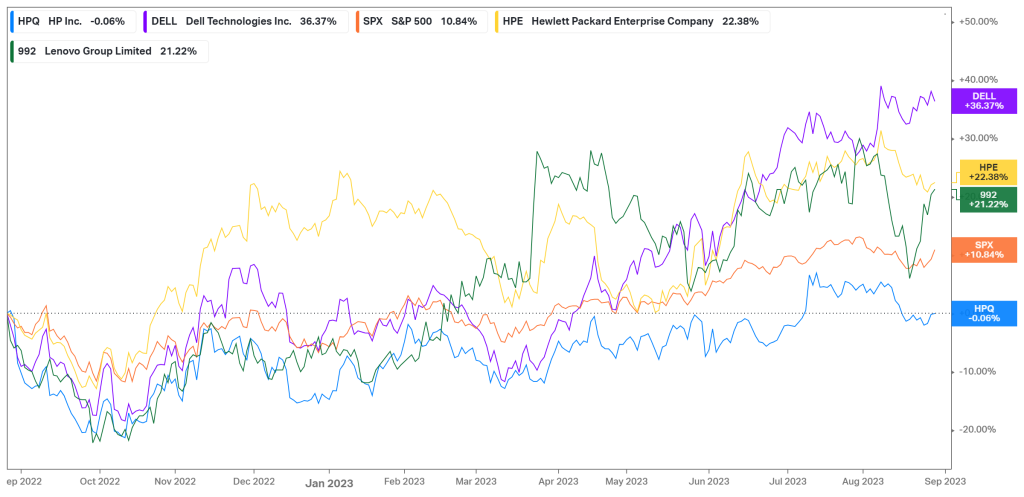

Over the last year, HP’s price has remained relatively flat at -0.06%. While taking part in the seasonal contractions of the industry, the company fell behind its competitors and the S&P 500 due to its lack of upside potential. Facing numerous headwinds with the higher interest rate and tight consumer spending weighing on the demand for their products, the company has struggled to enforce any sort of top-line growth. Apart from the lack of price return, the company’s shareholder returns have also declined significantly. In the 2022 financial year, HP bought back 125.9M shares while paying a $1 dividend per share, returning $5.33Bn to its shareholders. In the third quarter of 2023, no shares were repurchased, with its dividend per share falling to $0.26, with the company only returning $877M year to date to its shareholders. As we advance, can the company reverse its recent momentum, or is it just the beginning of a longer-term slump?

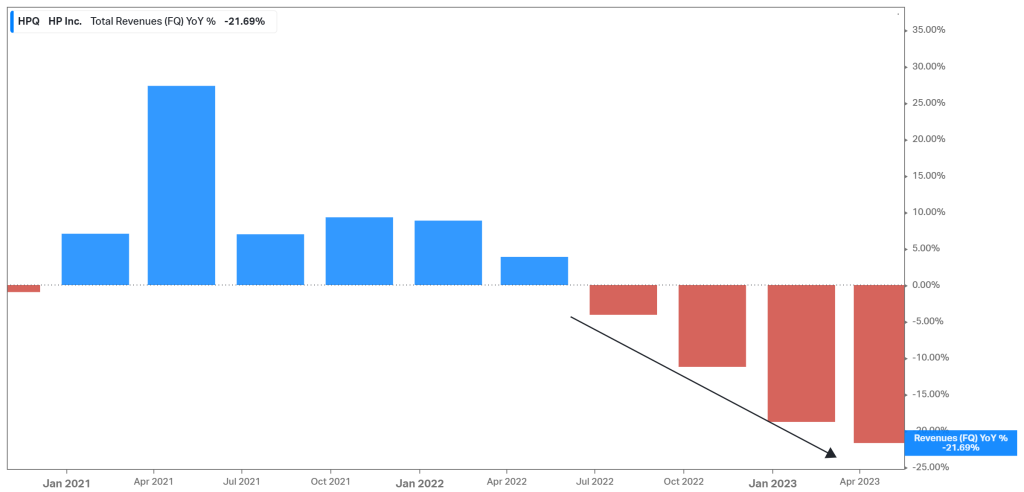

The graph below shows the company’s year-on-year revenue growth over the last few quarters heading into the earnings release. From revenue growth above 25% in 2021, the company’s top line has slumped into contractionary territory, with the recent quarter marking its fifth consecutive quarter of negative year-over-year growth. In Q3, revenue from its Personal Systems (PS) segment declined 11% year over year to $8.93Bn, driven by a 12% decline in Consumer PS revenue and an 11% contraction in Commercial PS revenue. Due to sluggish demand for PCs, the company had to initiate promotional pricing initiatives to drive sales. As a result, volumes in this segment were up 3%, but it wasn’t enough to offset the price reductions. In terms of the Printing segment, revenue declined 7% year over year to $4.26Bn, led by a 28% crash in Consumer Printing revenue and a 6% fall in Commercial Printing. Total hardware units fell 19% to round off a lacklustre top-line performance. As a result, management lowered its guidance for the upcoming quarter, projecting EPS of $0.85 – $0.97, tilting toward the lower end of the market’s $0.95 forecast. Similarly, its EPS outlook for the full fiscal year was revised down from $3.30 – $3.50 to $3.23 – $3.35, missing the market’s consensus for $3.37.

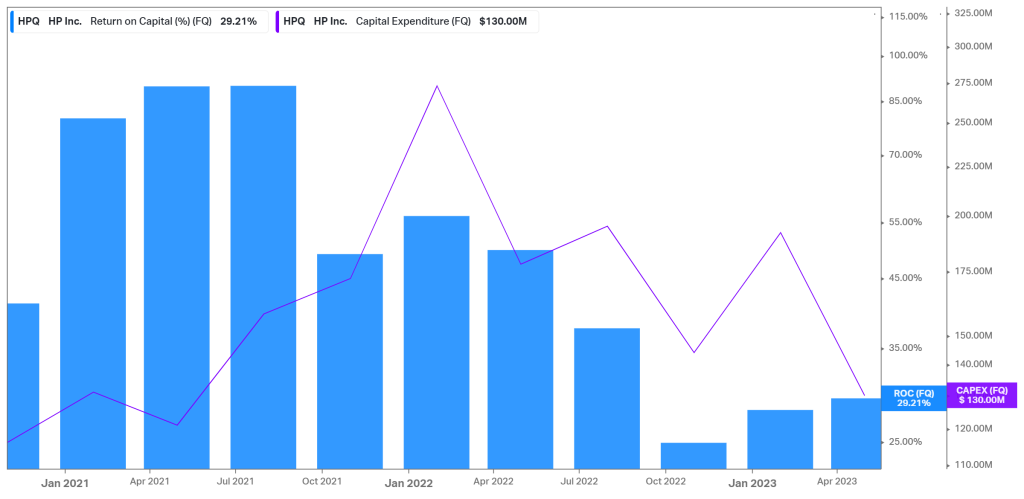

The company’s top-line struggles could be a testament to management’s capital allocation decisions. In the graph below, the company’s return on capital is shown to be on a significant downtrend. While it remains relatively healthy at 29.21%, it is nowhere near the heights it reached during 2021/2022. Management has also started spending less on capital expenditures, lowering from $275M in 2022 to $130M. This could be concerning for investors, as the company is neither increasing its shareholder returns in the form of dividends or repurchases nor investing heavily in its growth.

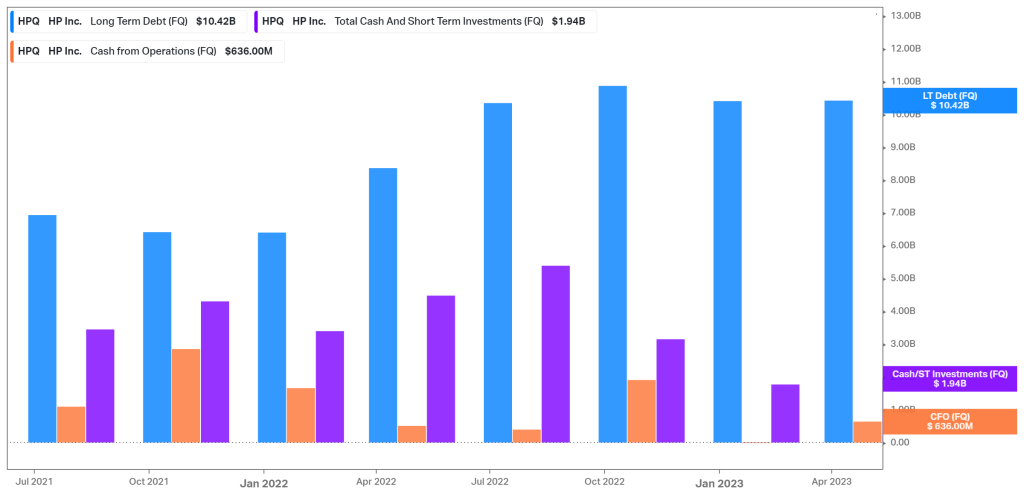

Furthermore, as shown in the graph below, HP has become increasingly levered with the rise in its long-term debt. In the October 2021 quarter, its debt position was easily covered with the company’s cash from operations and cash and short-term investments. Since then, the company has taken on more debt while generating lower cash from operations and reducing its cash and short-term investments. As previously mentioned, HP has not used its excess cash to return some money to its shareholders, and with a declining ROC and falling cash flows, there is cause for concern in management’s use of capital from its prominent debt position.

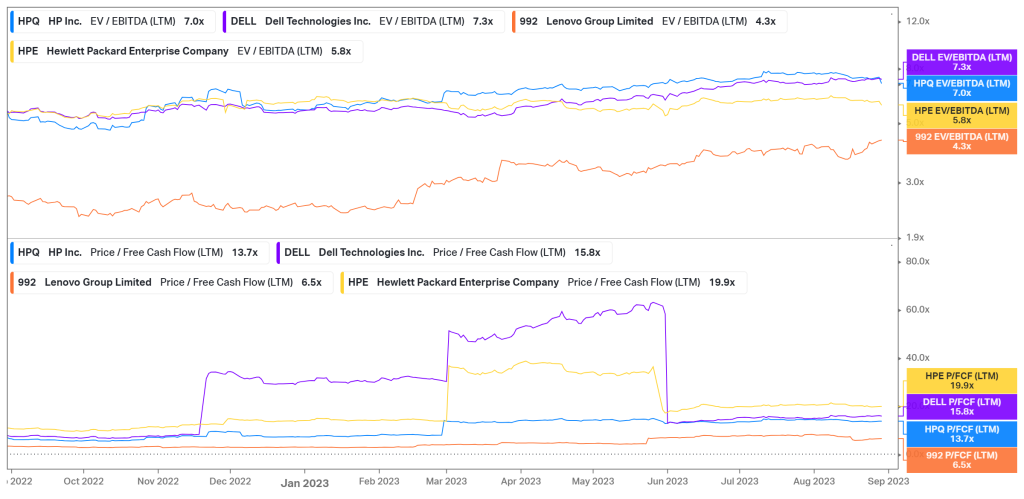

Due to its sluggish share price performance over the last year, HP’s valuation has remained within the industry range. With an EV/EBITDA of 7X, it trades on the higher end of the industry valuation spectrum. Its P/FCF of 13.7X places it quite well, but its cash flows are deteriorating and could result in inflated valuations in the future. While the company is not valued out of the industry norms, it is up to the investor to decide whether the current price reflects the balance sheet risk of the company’s increased leverage and its inability to expand its top line in the current macroeconomic environment.

Summary

In the third quarter of its fiscal year 2023, HP delivered earnings in line with consensus, while its top line declined more than expected. Management acknowledged an uncertain external environment, with macroeconomic conditions not favouring their growth prospects, as a PC slump and weak demand in China pressure its expansion. However, with a 10.74% after-market move, there could be an opportunity for a rebound in its share price in the upcoming sessions. If management can allocate its capital more efficiently to unlock the top-line growth it once had, the estimated fair value of $33.08 presents a 5.5% potential upside from current levels.

Sources: Koyfin, Tradingview, Yahoo Finance, Reuters, HP Inc.