The soda and snack giant, Pepsico Inc (NASDAQ: PEP), will have its investors smiling from ear to ear after reporting earnings that beat Wall Street expectations. Pepsico’s share price now trades at a new 52-week high with more room for upside gains likely.

Earnings per share came out at $1.50, beating expectations by 8.89%, while revenues landed on the $17.85B mark versus the $17.22B expected. Pepsico and its fiercest competitors faced a challenging 2022 but still came out on top. The most significant headwind was the rising costs of commodities and borrowing costs which Pepsico successfully managed to pass onto the consumer with its undisputed pricing power.

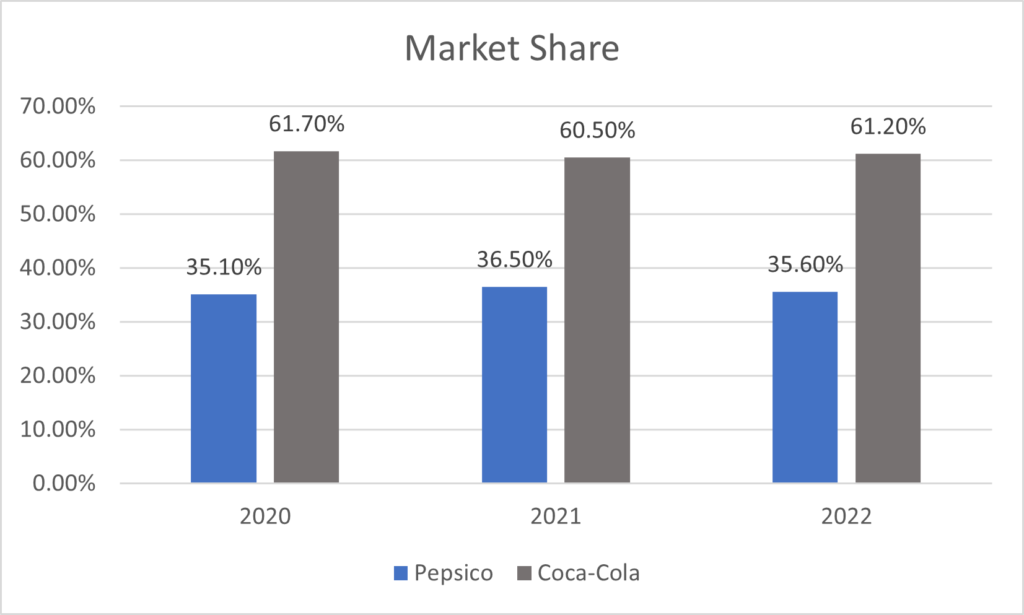

Source: Numerator

The Cola War rumbles on with Pepsico and The Coca-Cola Company (NYSE: KO) at the forefront of the battle for market share. The undisputed heavyweight champion remains Coca-Cola, and its number one contender, Pepsico, is just behind with about half the market share.

Pepsico and Coca-Cola’s share prices are positively correlated, given the alignment in the directional move of their share prices. However, Pepsico’s share price has outperformed Coca-Cola by over 40%, on revenues almost twice Coca-Cola’s, given Pepsico’s strong snack business, which includes household names such as Lays, Doritos, and Fritos.

Technical

Pepsico’s share price has been in an upward trajectory, with price trading in an ascending channel pattern, with the 100-day moving average below the price action. Support was established at the $168.65 per share level, while a prior all-time high at $186.66 per share formed resistance.

Following the upbeat earnings results, Pepsico’s share price surged to establish a new all-time high, closing at the $189.71 level in Tuesday’s trading session. The share price has largely respected its boundaries within the ascending channel pattern and the 100-day moving average.

The pattern’s support has been rejected thrice before and could present a sound long opportunity if the share price approaches the level. Long opportunities at the ascending channel’s support could be validated by price action approaching the level on weakening volumes, indicating the diminishing momentum of bears.

Fundamental

Despite facing increasing pressures of high commodity prices, labour and shipping costs and subdued consumer spending on the back of higher interest rates, Pepsico was able to offset these challenges by hiking prices for its drinks and snacks. Its consumers remained resilient in the face of a 16% higher average price, indicating Pepsico’s healthy pricing power.

Revenues picked up steam, gaining 10% to $17.85B, while organic revenues, which excludes revenue from acquisitions and divestitures, rose 14.3%, even with organic volumes slipping 2% against the quarter a year ago. The North America beverage unit sales, PepsiCo’s largest business, which houses 7UP and Gatorade, rose 8% in the quarter.

The bottom line came in better than expected but still fell far below the $4.26B recorded this quarter a year ago, driven by a 9.8% growth in Selling, general and administrative expenses. However, it was far from doom and gloom as the company’s executives announced an upbeat revision for the full-year outlook.

Given the resilient consumers across Pepsico’s global footprint, organic revenue is forecast to move northward 200 basis points from the prior forecast of 6%. At the same time, earnings were revised upwards, now $7.27 per share compared with $7.20 per share earlier.

After discounting for future cash flows, a fair value of $202.96 per share was derived. With price trading at the $189.15 per share level in pre-market, there is room for a 7.30% upside gain.

Summary

Pepsico’s investors are likely to keep their foot on the pedal as they look to attain new highs beyond the current 52-week high. If the company maintains elevated sales, its earnings could come out stronger in the following quarters, making its $202.96 fair value a probable destination for the share price.

Sources: PepsiCo Inc, CNBC, Reuters, Numerator, Koyfin, TradingView