The Procter & Gamble Company (NYSE: PG) reported third-quarter earnings for the 2023 fiscal year, which sent the share price soaring over 3% on a double beat. With their top and bottom-line exceeding analysts’ expectations, management guided optimistically for the upcoming quarter as the consumer staple giant showed resilience against a tricky macroeconomic environment.

The company reported earnings per share growth of 3% to $1.37, exceeding the $1.32 expectation. Similarly, net sales expanded by 3% to $20.1Bn from the $19.38Bn generated in the third quarter last year, with analysts expecting a contraction to $19.32Bn. Heading into the final quarter, management upgraded their overall sales growth outlook for 2023 to 1%, from their previous projection of a 1% contraction. On an organic basis, the company expects 6% growth from the prior forecast of 4%-5%. The company gapped up almost 3% on the positive outlook, where the bulls refused to allow a bearish correction. Unsurprisingly, this was the biggest daily move on the S&P 500 on a volume and return basis, as shown in the graph below.

Technical

On the daily chart, the share price was in an uptrend prior to the earnings release, where the 50-day and 200-day moving averages converged to form a golden cross. The share price closed above the psychological resistance of $154.47, a level the market has historically resisted.

Even though the bulls hold the momentum, the RSI indicates overbought conditions, which could entice the bears to close the gap at $150.71, the 78.6% Fibonacci retracement from the February bottom. In this case, the bears could look to generate some momentum toward $148.63, $147.60 and $145.41 as the following potential support levels, as a macroeconomic downturn could continue to weigh on the equity market.

However, with the company showing resilience under challenging conditions, it could again break through the $154.47 resistance to converge with its estimated fair value on a discounted cash flow basis at $159.19. In this case, the company offers a potential 2% upside from current levels, with any interim downside movements widening the upside potential.

Fundamental

Rising inflation, commodity costs and foreign exchange headwinds headlined the challenges faced by the company as consumer spending comes under threat amid a global recessionary environment. However, when analysing the company’s earnings, it becomes clear that its business model provides insulation against the cyclical risks of the economic cycle. What management describes as “superior products” creates a sense of brand loyalty that provides a competitive advantage against its industry peers. On a segmental basis, this advantage becomes clear.

In terms of net sales, all their operating segments underwent growth in the latest quarter. The Beauty segment grew by 3% to $3.49Bn, with Grooming up 1% to $1.5Bn. Healthcare expanded the most, with a 6% net sales growth to $2.82Bn, with Fabric & Home Care a close second with a 5% growth to $7.02Bn. Finally, Baby, Feminine & Family Care was up 3% at $5.06Bn. While these numbers don’t stand out on their own, it becomes significant considering that all segments except for Beauty and Healthcare saw a decline in volumes, with Fabric & Home Care volumes contracting by 5%. Overall, the company’s volumes declined by 3%, while net sales grew by 4%.

The reason for the expansion is price hikes. Due to the company’s strong competitive brand advantage, it can effectively pass its rising input costs onto its consumers to offset the lower volumes. In the latest quarter, price increases of 10% offset the 3% contraction in volumes. On a segmental basis, the most significant price increases came from their Grooming and Fabric & Home Care segments, with a 10% and 13% increase, respectively. Analysts expected consumers to trade down their spending to cheaper alternatives from Procter & Gamble’s popular brands. Still, management revealed that their private labels (cheaper brands) only gained around 20bps of share in the latest quarter, suggesting that consumers are not significantly trading down. In fact, management believes that shoppers are not buying cheaper but rather engaging in more careful use of their products, suggesting the consumers are holding up well.

The company still faces numerous headwinds heading into the new quarter. Rising costs and foreign exchange headwinds threaten their continued growth. In the latest quarter, foreign exchange movements accounted for a 4% contraction in sales, as a strong US dollar pressures international sales on a constant currency basis. However, management lowered their cost expectations to $3.5Bn, from the prior $3.7Bn projection, which could affect their full-year profit by $1.40 per share. Amid these cost pressures, the company still reported a 150bps rise in their gross margin to 48.2%, raising questions about potential “greedflation” as the company is pushing prices up faster than their expenses are rising, boosting their profitability at the expense of their customers.

Along with its insulation against the macroeconomic cycle, the company has provided shareholders with healthy returns over the last five years. The graph below demonstrates how the consumer staples sector has outperformed the S&P 500 by almost 20% since July 2018. Not only did Procter & Gamble appreciate the most out of its industry peers, but it also awarded shareholders nearly double the returns of the consumer staples sector, showing its competitive advantage.

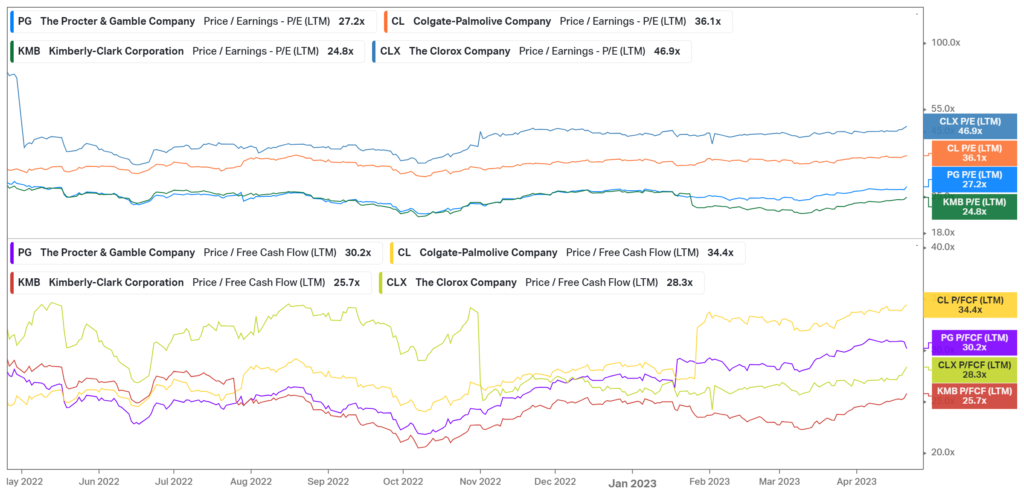

However, with the significant price appreciation, the company has become slightly more expensive than some of its industry peers. With a P/E valuation of 27.2X on a P/FCF of 30.2X, it trades at a slight premium relative to competitors. However, a small premium could be justified with its robust business model and potential insulation against the macroeconomic environment.

Summary

After a strong Q3 earnings report, Procter & Gamble looks well situated to weather economic storms. However, from current levels, there is only a 2% potential upside to its estimated fair value of $159.19. However, any interim movements could widen the upside potential for the bullish investors seeking to possibly insulate themselves from the macroeconomic cycle.

Sources: Koyfin, Tradingview, Reuters, Yahoo Finance, TheStreet, The Procter & Gamble Company