Deere & Company (NYSE: DE) reported their third-quarter results for fiscal 2023 on Friday, hoping to harvest the rewards of favourable agriculture conditions and sustained innovation in an industry where they comfortably sit on the throne. However, the share price reaction reminded investors that the market is as dynamic as the fields that Deere’s equipment cultivates, as the lack of belief in the sustainability of the agriculture boom triggered some cautious profit-taking that sent the share price plummeting into the ground.

The company reported earnings per share (EPS) of $10.20 on net sales of $14.28Bn. Compared to the same quarter last year, the company realized a massive 66% growth on their bottom line and 9% on the top line, smashing the prior period’s $6.16 EPS on net sales of $13Bn, while exceeding the estimates for $8.18 on net sales of $14.06Bn. As a result, management lifted their guidance for net income from $9.25Bn – $9.50Bn to $9.75Bn – $10Bn, impressing the market that predicted a $9.38Bn forecast. Management went on to cite a positive farming and construction environment with fundamentals that favour increased demand for their famous machinery. So, can the company continue to dominate in upcoming quarters, or is the market correct in predicting a peak in the agriculture boom?

Technical

On the 1D chart, a descending channel became the victim of a bullish breakout that led to a period of sustained upside in the company’s share price. However, following the latest earnings release, a double top formation in a longstanding supply zone received confirmation for a bearish pullback that resulted in the share price gapping below the 50-day moving average on a high-volume selloff.

However, with the RSI pointing to oversold conditions, the bulls remain in contention as the new week begins. The share price closed close to the Fibonacci midpoint at $396.39 from the late July peak, with a golden cross formation signalling shorter-term bullish momentum, which could entice a pivot toward the upside on the market open. If the share price moves lower in the opening hours on Monday, the Fibonacci golden ratio at $384.53 could be a potential level of interest for convergence with the estimated fair value of $429.56. From current levels, this poses an 8.13% potential upside.

However, the downward momentum could continue if volumes remain elevated on Monday for a push below the golden ratio. In this case, lower support at $369.64 and $346.96 could come into play in the upcoming weeks.

Fundamental

Deere & Company have situated itself nicely within the farming equipment industry, and due to its proven track record and continuous innovation, it possesses the pricing power that gives them a massive economic moat during challenging times. Investors have drawn their attention to the company’s value, resulting in a stellar 182.40% price return over the last five years. Excluding their dividend payments, which is one of the selling points of the company, they outperform their closest competitor, Caterpillar (96.50%), the S&P 500 (53.32%), and the broader industrial sector (39.26%) by some distance over the same period. However, the industrial sector is naturally cyclical, which begs the question of how long the recent boom can last and whether we are starting to see cracks in the fundamentals that opened a runway to their sustained performance over the last three years.

Source: FairMarkets Australia – Koyfin, Tiaan van Aswegen

In the latest quarter, their biggest segment, Production & Precision Agriculture, was up 12% at $6.81Bn, benefitting immensely from price increases, while volumes remained solid. The company forecasted close to 20% growth for this segment for the full-year 2023, painting a healthy demand picture for the next quarter. The Small Agriculture & Turf segment expanded by 3% to $3.74Bn, once again benefitting from price increases, but volumes started to subside, resulting in an adverse effect of $59M on operating profit. Nevertheless, the company expects a 5% growth in sales for the full year. Construction and Forestry rounded off a solid segmental performance across the board with 14% growth to $3.74Bn, once again benefitting from price and volume increases, leading to an upgrade in the guidance for the fiscal year for this segment from 15% sales growth to 15%-20%, with an operating margin forecast of 18.5% – 19.5%, a massive improvement from last year’s 16.1%.

While price increases led to their bottom-line growth, the graph below paints a slightly concerning picture in the fact that volumes negatively affected operating profit overall for the quarter compared to last year’s figure. This formed the starting point of the discussion around Deere’s future for the upcoming quarters, as an industry shift may strain their ability to grow their bottom line sustainably.

Source: FairMarkets Australia – Koyfin, Tiaan van Aswegen

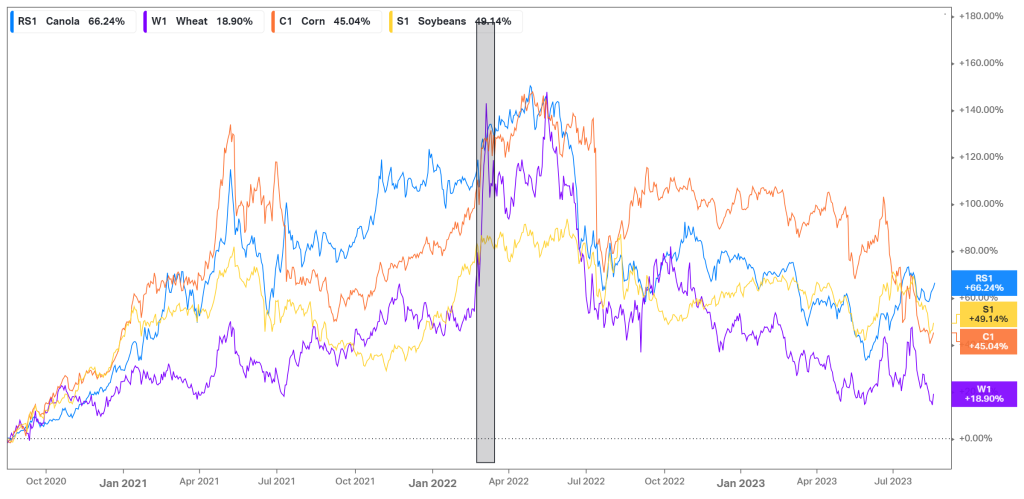

The industry as a whole has been facing some supply chain constraints, which have caused the prices of farming equipment and machinery to rise, much to the benefit of Deere due to its pricing power in the industry. However, these supply chain headwinds are starting to fade, which could resist its ability to raise its prices sustainably. This is where volume comes into play. In the wake of Russia’s invasion of Ukraine, global crop prices went soaring, as shown in the graph below. Farmers started paying up for machinery to maximize supply at the higher crop prices, which aided Deere’s volume growth. However, the graph shows the crop market beginning to normalize, with corn futures recently reaching their lowest level since 2020, before the initial surge occurred. The moderating crop prices and fading of supply chain headwinds signal a shift in the industry, taking some power away from Deere in terms of growing through price. Cyclical demand headwinds in the agriculture sector may soon come into play. This could further weigh on already decreasing volumes as the agriculture boom retreats into a potential bust cycle. This concern was the leading cause of the Friday selloff, as investors are cautious and may need to see some volume improvement in their Q4 earnings to convince them of the growth sustainability when price is taken out of the equation.

Source: FairMarkets Australia – Koyfin, Tiaan van Aswegen

Another potential headwind is the company’s growing debt position. In the graph below, it is seen that Deere’s debt position has been rapidly increasing. Without enough cash in the balance sheet, the company may have to refinance its debt at higher rates when it comes due, which could be challenging if a potential bust in the agriculture sector occurs. However, this is not necessarily a short-term concern based on the portion of their long-term debt coming due soon. The graph demonstrates that the company’s cash position covers its short-term debt for now. Still, it is worth keeping an eye on the developments in its capital structure, as large amounts of debt coming due could hinder its dividend-paying ability and ability to continue to innovatively grow its fleet of machinery to meet future demand.

Source: FairMarkets Australia – Koyfin, Tiaan van Aswegen

Summary

It is no secret that Deere & Company is showing positive signs of a robust demand environment in their latest financial reports. However, the sustainability of this is coming under question as the crop market normalizes and supply chain constraints start to ease. However, if the company can continue growing its volumes through its impressive industry position and continuous innovation, the estimated fair value of $429.56 provides an 8.13% potential upside from current levels.

Sources: Koyfin, Tradingview, TheStreet, Investor’s Business Daily, Deere & Company.